A little investment from California fund goes a long way at VF Corp., the troubled Denver company whose brands include The North Face, Vans, Timberland and Dickies.

A little investment from California fund goes a long way at VF Corp., the troubled Denver company whose brands include The North Face, Vans, Timberland and Dickies.

A Newport Beach, CA, activist fund that held just $82 million or 1.4 percent of VF Corp.’s shares this spring won two independent board seats and weighed in on the layoffs, hirings and jettisoning of brands from the outdoor apparel and footwear giant. Engaged Capital believes that VF can raise its share price, now $16.50, to the mid-$40s within three years.

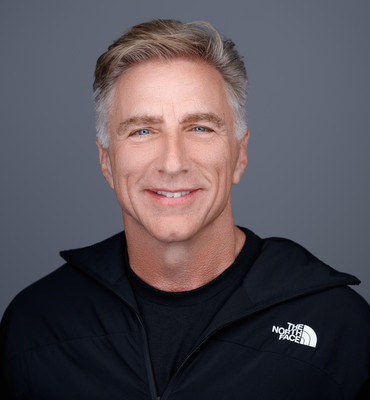

“We really tried to cooperate with Engaged and they’ve cooperated with us,” VF CEO Bracken Darrell told BusinessDen. “It’s a good thing they pushed for changes.”

Bracken Darrell, 62, has been CEO at VF Corp. for one year.

Darrell took over at VF in July 2023 after a decade turning around Logitech International S.A. of Lausanne, Switzerland. He has made dramatic changes since Engaged announced its stake in October.

Darrell replaced the heads of The North Face and Vans, which jointly make up two-thirds of sales. He created a regional platform to focus on the Americas, where it sells half its products. Darrell sold off the streetwear label Supreme in July for $1.5 billion, in part to pay down its $6 billion debt. Last year, VF slashed its dividend and used the cash in part to pay down $540 million in debt.

The activist fund, which listed $753 million in assets under management and just eight clients in late July, has in the past taken stakes at Shake Shack, ATM maker NCR, Abercrombie & Fitch, Hain Celestial, Jamba Juice and Boulder Brands, the Colorado maker of packaged health foods.

Engaged Capital invests in undervalued companies it believes are solid but mismanaged, ones that are too small for many Wall Street analysts to cover and for larger funds to target. They say their research on a company’s customers, competitors and missteps manages to “catalyze change” 75 percent of the time, winning them seats on sleepy boards. They aim to constructively engage management to fix problems in operations, strategy and execution.

Often, their insights come as no surprise to the CEOs.

“Most companies we walk into suffer from what I call ‘Ready, Aim, Aim, Aim, Aim behavior,’” said Glenn W. Welling, who founded Engaged in 2012, in an April podcast. “We force them to pull the trigger on tough decisions.” Engaged declined to be interviewed for this story.

HQ Blunder

Part of Engaged’s October investor presentation.

For Engaged, one blunder was VF’s 2019 creation of a Denver headquarters, which centralized its design, supply chain, retail and analytics, and also housed five of its outdoor brands. In the October investor presentation disclosing its VF stake, it called the Denver HQ a “Corporate Death Star,” illustrating the point with the Empire’s planet-destroying space station from Star Wars.

The decision by former CEO Steve Rendle to move from Greensboro, NC, “drove a steep change in costs,” left behind good employees, reduced brand autonomy and starved Vans, then the company’s largest brand, of resources to innovate.

Darrell’s $1.5 billion sale of Supreme in July was an effort to undo another mistake he inherited. VF bought the streetwear brand in 2020 for $2.1 billion, loading VF with debt. The company took $735 million in charges to write down worthless assets in 2023.

“He’s taken action on all fronts,” said Wayne Cascio, emeritus professor of management at the University of Colorado Denver. “He deserves credit.”

VF expanded its board to make room for two independent directors, as Darrell agreed with Engaged that the board needed apparel and footwear experience.

Lest anyone miss its role, Engaged Capital appears in the headline (“VF Capital Aligns with Engaged Capital and appoints Caroline Brown to Board”) and seven other times in VF’s February announcement of board changes. “We appreciate the constructive input provided by Engaged Capital over the past several months and look forward to continuing our dialogue with Engaged Capital and other shareholders as we continue improving the company’s performance,” said VF board chair Richard Carucci. Welling was quoted purring in the same announcement, saying that the former head of DKNY and Donna Karan International would bring “a wealth of apparel experience to the boardroom.”

Four months later, Brown left the board to run The North Face. VF appointed two independent directors, Mindy Grossman, who modernized the Home Shopping Network and led Weight Watchers until Ozempic and other weight loss injections ran it aground, and Wendy’s CEO Kirk Tanner, a longtime PepsiCo executive. The VF press release quoted Welling praising the moves: “All three additions bring invaluable skills to the Company and will play important roles in helping accelerate VF’s strategic and business transformation.”

Shift from the corporate raiders and hostile takeovers of the 1980s

This coziness between companies and funds targeting them marks a shift in activist investing, away from the hostile takeover bids and corporate raiders of the 1980s. Bent on short-term gains, these hostile investors extracted so much that they weakened their targets, getting rich at the expense of long-term investors like pension and insurance funds, notes Jeff Gramm, author of “Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism.”

A new generation of hedge fund managers, without a lot of capital, started to do research into how to turn around underperforming companies. The large institutional investors “figured out that these hedge fund guys are doing a lot of the dirty work” and agreed “with a lot of what they are saying,” Gramm said in an interview with the Financial Times. “So now you can go explain your case to the three biggest shareholders and they’re going to listen.”

In the case of VF, Engaged in February won over a grandson of VF founder James Barbey, whose family controls 15 percent of shares, Reuters reported. It’s not clear how much influence he has on his relatives.

So how does Engaged have so much power over a company when it holds such a small percentage of its stock? It seems it’s not the size of the stake, but the skill of those who wield it.

“Ownership of stock just gives you the chance to talk to the CEO and board,” said Sanjai Bhagat, a corporate governance expert at University of Colorado Boulder’s Leeds School of Business. “After that, your ideas come to stand on their own.”

Engaged develops its ideas from its offices in an 18-story skyscraper that looks out onto the Pacific, the Santa Ana mountains and the harbor of Newport Beach, a hub for quantitative financial firms. The team of seven sifts through data on 1,400 small and medium-cap firms that appear to be seriously undervalued, looking for opportunities to invest in eight to 10 companies that can improve their performance within two to five years.

“When we arrive, no one ever wants us there. You get used to that sense of rejection,” Welling said in the podcast. “But once we’ve been there for 90 days, no one ever wants us to leave, because we’re bringing so much insight.”

Since Engaged is a minority investor, other shareholders make money whenever it does.

So far, profit at VF appears, like The North Face, beyond the summit. While VF stock jumped 10 percent when Engaged announced its stake, it now trades around the same level.

Engaged continues to sift through opportunities. It never stops exploring.