A former hotel owner in LoDo has been charged with defrauding the federal government by lying on loan applications and then using the public money for personal purchases.

Amin Suliaman, 47, was arrested in Miami on Tuesday, one week after a federal grand jury indicted him on four counts of wire fraud. Suliaman, who moved from Colorado to Houston in 2022, faces up to 20 years in prison and $900,000 in fines if convicted.

“We look forward to our day in court,” his lawyer, Harvey Steinberg of Springer & Steinberg, said Wednesday. “We feel that we will be completely vindicated and that will happen, hopefully, sooner than later.”

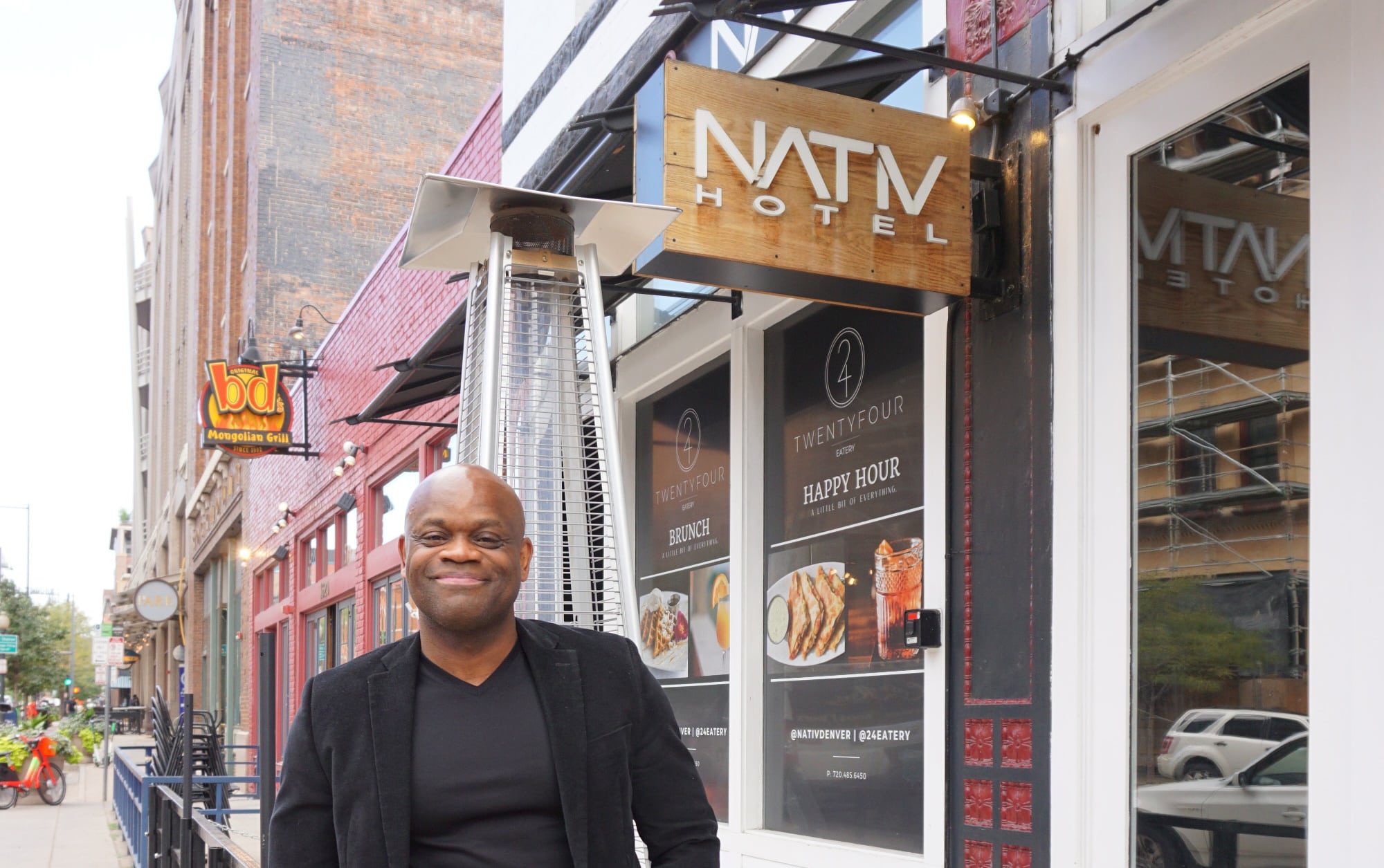

Suliaman once operated several businesses in Colorado and co-owned the Nativ Hotel at 1612 Wazee St. from 2018 until it closed in 2020. After a contentious foreclosure process, a bankruptcy and a failed auction, 1612 Wazee was sold for $6 million in 2022.

Last week’s grand jury indictment accuses Suliaman of taking $450,000 from taxpayers through the use of fraudulent applications for Economic Injury Disaster Loans, or EIDLs, a pandemic-era program from the U.S. Small Business Administration meant to aid ailing companies.

In November 2020, Suliaman applied for an EIDL on behalf of Loft Brokers, a Denver company of his that developed high-end lofts. According to the indictment, his application falsely claimed that the company had several employees and $1.5 million in sales pre-pandemic. In reality, it had no employees or revenue at the start of 2020, the government said.

One week later, Suliaman applied for an EIDL on behalf of a property he owned at 7172 W. 38th Ave. in Wheat Ridge, again claiming that his company had several employees and revenue of $1.2 million on the eve of the pandemic. Bank records allegedly proved that to be false, but not before the SBA gave both of his two idle companies $150,000 in EIDLs.

In one instance, the SBA spotted Suliaman’s alleged fraud, according to the indictment. In January 2021, he applied for a loan on behalf of 607 22nd St., claiming the pandemic was costing it rental revenue. But Suliaman had sold that property two years before.

“When the SBA requested additional documents, Suliaman provided a fabricated bank statement and water bill to make it appear the entity was operating in December 2020, which Suliaman knew was false,” prosecutors say. “The SBA declined to fund this application.”

The Nativ Hotel sold for $6.3 million in 2022. (BusinessDen file)

Suliaman is accused of spending that first $300,000 on travel, rent, “large cash withdrawals” and unspecified “retail purchases.” Then, when he needed more money in 2022, he allegedly filed one more false loan application — this time, on behalf of his hotel in LoDo.

As the Nativ was facing foreclosure and being prepared for auction, Suliaman asked the SBA to loan $150,000 “for working capital of Nativ Denver to alleviate economic injury caused by the COVID-19 pandemic,” while vowing he “would not make any distribution or advance to himself or other companies he controls,” the indictment alleges. The SBA loaned the money.

Suliaman is accused of then using that money “to open and operate nightclubs in Texas,” including paying off past-due rent and “old debts of the nightclubs.”

“At the time Suliaman requested additional funds on April 18, 2022, Suliaman knew that the business Nativ Denver had ceased operating the Nativ Hotel,” prosecutors allege.

For the three allegedly fraudulent loans that he did receive and the fourth loan application that was denied by the government, Suliaman faces four counts of wire fraud, a federal felony. Assistant U.S. Attorney Craig Fansler in Denver is prosecuting the case.

In an unrelated case, Suliaman and the Nativ Hotel are being sued by two men who were injured during a shooting there in 2022, when a portion of the Nativ was being used as a nightclub. Suliaman is accused of failing to take security precautions before the shooting. That case is on hold until the alleged shooter’s criminal case can be resolved.

A former hotel owner in LoDo has been charged with defrauding the federal government by lying on loan applications and then using the public money for personal purchases.

Amin Suliaman, 47, was arrested in Miami on Tuesday, one week after a federal grand jury indicted him on four counts of wire fraud. Suliaman, who moved from Colorado to Houston in 2022, faces up to 20 years in prison and $900,000 in fines if convicted.

“We look forward to our day in court,” his lawyer, Harvey Steinberg of Springer & Steinberg, said Wednesday. “We feel that we will be completely vindicated and that will happen, hopefully, sooner than later.”

Suliaman once operated several businesses in Colorado and co-owned the Nativ Hotel at 1612 Wazee St. from 2018 until it closed in 2020. After a contentious foreclosure process, a bankruptcy and a failed auction, 1612 Wazee was sold for $6 million in 2022.

Last week’s grand jury indictment accuses Suliaman of taking $450,000 from taxpayers through the use of fraudulent applications for Economic Injury Disaster Loans, or EIDLs, a pandemic-era program from the U.S. Small Business Administration meant to aid ailing companies.

In November 2020, Suliaman applied for an EIDL on behalf of Loft Brokers, a Denver company of his that developed high-end lofts. According to the indictment, his application falsely claimed that the company had several employees and $1.5 million in sales pre-pandemic. In reality, it had no employees or revenue at the start of 2020, the government said.

One week later, Suliaman applied for an EIDL on behalf of a property he owned at 7172 W. 38th Ave. in Wheat Ridge, again claiming that his company had several employees and revenue of $1.2 million on the eve of the pandemic. Bank records allegedly proved that to be false, but not before the SBA gave both of his two idle companies $150,000 in EIDLs.

In one instance, the SBA spotted Suliaman’s alleged fraud, according to the indictment. In January 2021, he applied for a loan on behalf of 607 22nd St., claiming the pandemic was costing it rental revenue. But Suliaman had sold that property two years before.

“When the SBA requested additional documents, Suliaman provided a fabricated bank statement and water bill to make it appear the entity was operating in December 2020, which Suliaman knew was false,” prosecutors say. “The SBA declined to fund this application.”

The Nativ Hotel sold for $6.3 million in 2022. (BusinessDen file)

Suliaman is accused of spending that first $300,000 on travel, rent, “large cash withdrawals” and unspecified “retail purchases.” Then, when he needed more money in 2022, he allegedly filed one more false loan application — this time, on behalf of his hotel in LoDo.

As the Nativ was facing foreclosure and being prepared for auction, Suliaman asked the SBA to loan $150,000 “for working capital of Nativ Denver to alleviate economic injury caused by the COVID-19 pandemic,” while vowing he “would not make any distribution or advance to himself or other companies he controls,” the indictment alleges. The SBA loaned the money.

Suliaman is accused of then using that money “to open and operate nightclubs in Texas,” including paying off past-due rent and “old debts of the nightclubs.”

“At the time Suliaman requested additional funds on April 18, 2022, Suliaman knew that the business Nativ Denver had ceased operating the Nativ Hotel,” prosecutors allege.

For the three allegedly fraudulent loans that he did receive and the fourth loan application that was denied by the government, Suliaman faces four counts of wire fraud, a federal felony. Assistant U.S. Attorney Craig Fansler in Denver is prosecuting the case.

In an unrelated case, Suliaman and the Nativ Hotel are being sued by two men who were injured during a shooting there in 2022, when a portion of the Nativ was being used as a nightclub. Suliaman is accused of failing to take security precautions before the shooting. That case is on hold until the alleged shooter’s criminal case can be resolved.