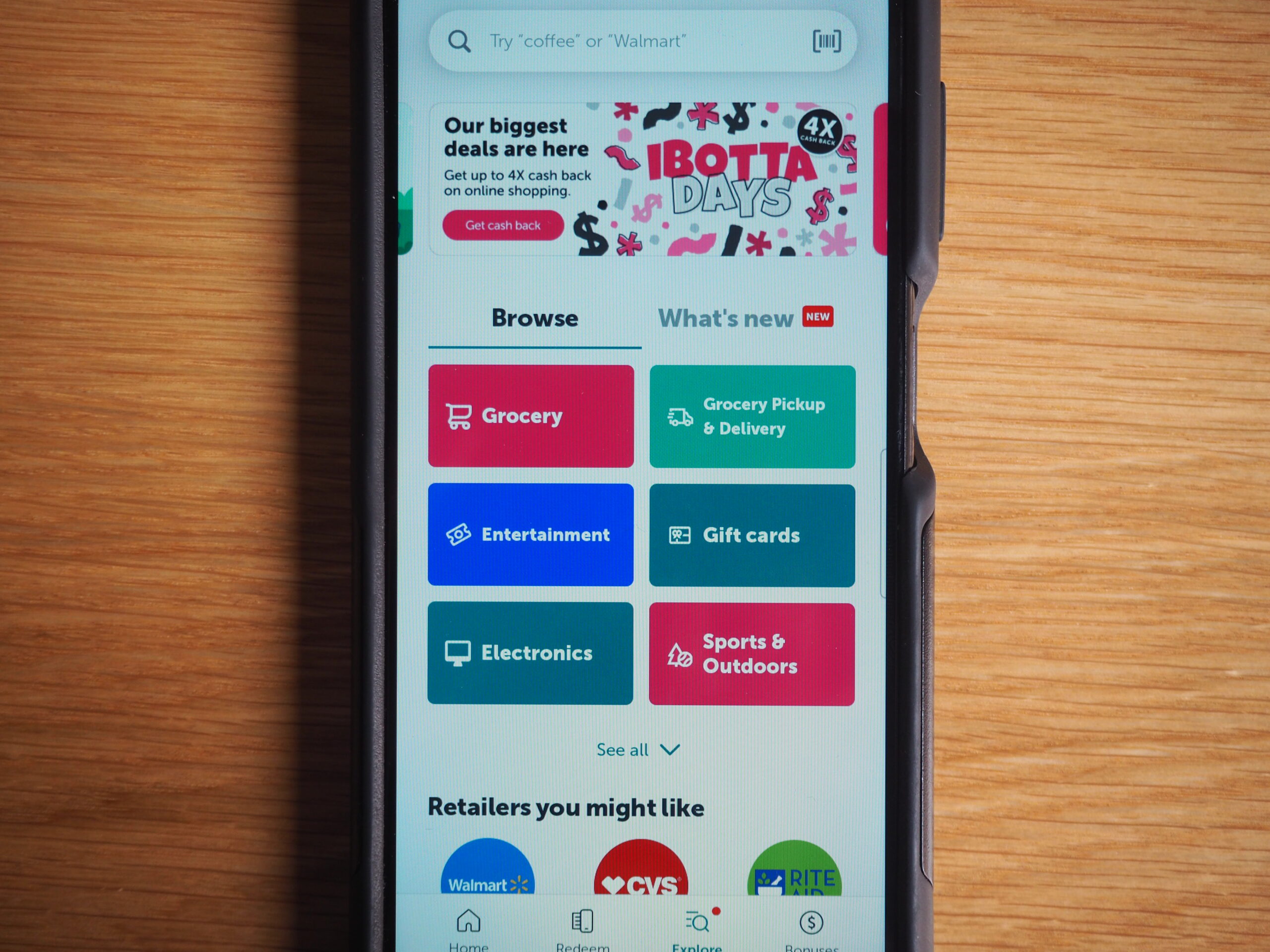

The current version of Ibotta’s app, which was introduced in 2012. (BusinessDen file)

In 2011, Bryan Leach quit his job as partner at the law firm Bartlit Beck to start a company called Zing Enterprises.

On Thursday, 13 years later, Leach rang the ceremonial bell at the New York Stock Exchange to mark the start of the trading day, which saw his Denver-based company — now called Ibotta — go public.

Bryan Leach

Ibotta and existing shareholders raised $577 million as they sold 6.6 million shares at $88 apiece, slightly above the originally expected $76 to $84 range.

Shares of IBTA jumped from there, hitting a high of about $117 before closing the day at about $103, up 16% on the IPO price.

Ibotta offers a modern version of couponing, in which customers get rebates when purchasing specific products from eligible stores. Companies pay Ibotta when a customer buys an item.

Last month, when Ibotta filed to go public, the company disclosed that it was profitable in 2023. According to SEC filings, Ibotta made $38.1 million on $320 million in revenue last year, compared to a loss of $54.9 million off $210.7 million in revenue in 2022.

The company is headquartered downtown at 1801 California St. and had 815 employees at the end of last year.

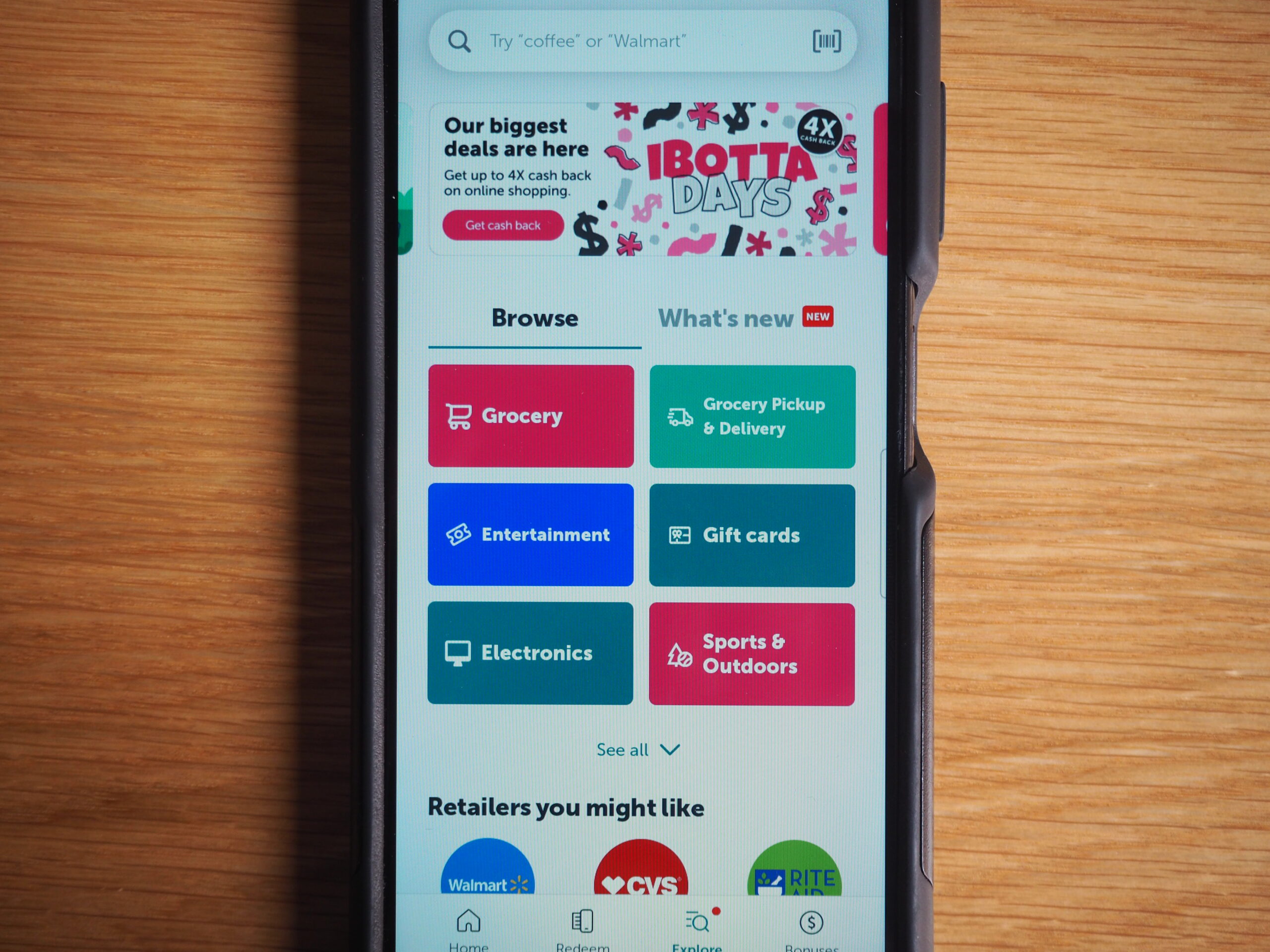

The current version of Ibotta’s app, which was introduced in 2012. (BusinessDen file)

In 2011, Bryan Leach quit his job as partner at the law firm Bartlit Beck to start a company called Zing Enterprises.

On Thursday, 13 years later, Leach rang the ceremonial bell at the New York Stock Exchange to mark the start of the trading day, which saw his Denver-based company — now called Ibotta — go public.

Bryan Leach

Ibotta and existing shareholders raised $577 million as they sold 6.6 million shares at $88 apiece, slightly above the originally expected $76 to $84 range.

Shares of IBTA jumped from there, hitting a high of about $117 before closing the day at about $103, up 16% on the IPO price.

Ibotta offers a modern version of couponing, in which customers get rebates when purchasing specific products from eligible stores. Companies pay Ibotta when a customer buys an item.

Last month, when Ibotta filed to go public, the company disclosed that it was profitable in 2023. According to SEC filings, Ibotta made $38.1 million on $320 million in revenue last year, compared to a loss of $54.9 million off $210.7 million in revenue in 2022.

The company is headquartered downtown at 1801 California St. and had 815 employees at the end of last year.