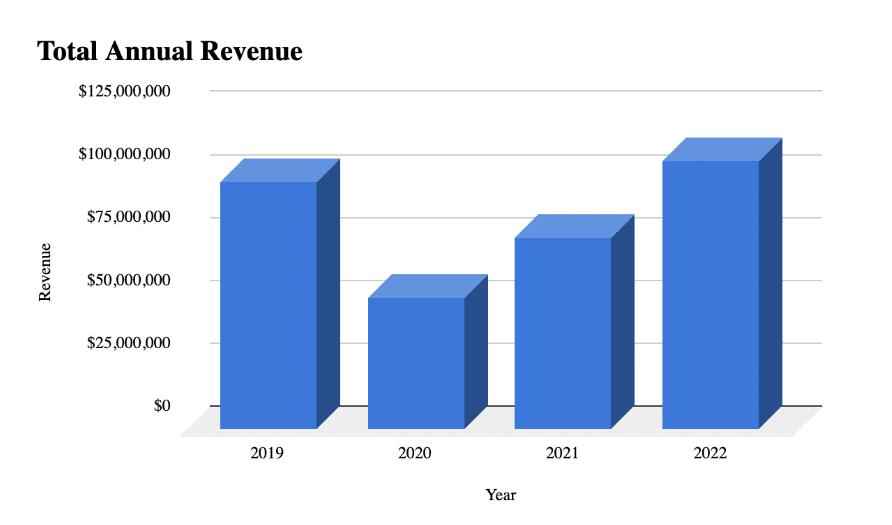

Guests paid a record $106.5 million last year to skip the hotel and stay at Denver properties booked through companies like Airbnb and Vrbo, according to a BusinessDen analysis using tax revenue data provided by the city.

That exceeds 2021 short term rental volume by $30 million and surpasses 2019, the previous peak, by $7.9 million.

The rentals brought in $11.4 million in tax revenue to the city in 2022, the highest amount ever recorded, Department of Finance spokeswoman Courtney Meihls said.

The city’s lodger’s tax rate is assessed at 10.75 percent of the total cost for lodging facilities with fewer than 50 rooms.

Properties booked through sites like Airbnb are required to be licensed by the city and must adhere to various regulations, most notably that the property must be someone’s primary residence.

Eric Escudero, communications director for Denver’s Department of Excise and Licenses, said there were 2,580 active licenses as of Feb. 9.

That number was up 21 percent compared to February 2022, he said. And critically, it was slightly more than the previous peak of 2,575 licenses the city reached in March 2020.

“Denver has surpassed the number of active short-term rental licenses that there were when the pandemic struck,” Escudero said in an email. “This signals the tourism industry in Denver may have fully recovered.”

AirDNA, a Denver-based company, collects data on short-term rentals, including pricing trends, demand and revenue. Vice President Jamie Lane said Denver has yet to return to its number of pre-pandemic bookings, but revenue has recovered because the cost of stays has increased. He said prices increased substantially in 2021 and through the first half of 2022.

“If people are paying higher rates, then generally the revenue recovery is going to happen before demand recovery,” Lane said.

Prices in the market began to normalize at the end of the year, with only 6 to 7 percent growth, according to AirDNA data. Lane said this was due to more rentals popping up on the market.

“We’re now sort of catching back up with that pre-pandemic level,” Lane said. “It’s going to take a bit more growth, but I suspect we will get there in 2023.”

Guests paid a record $106.5 million last year to skip the hotel and stay at Denver properties booked through companies like Airbnb and Vrbo, according to a BusinessDen analysis using tax revenue data provided by the city.

That exceeds 2021 short term rental volume by $30 million and surpasses 2019, the previous peak, by $7.9 million.

The rentals brought in $11.4 million in tax revenue to the city in 2022, the highest amount ever recorded, Department of Finance spokeswoman Courtney Meihls said.

The city’s lodger’s tax rate is assessed at 10.75 percent of the total cost for lodging facilities with fewer than 50 rooms.

Properties booked through sites like Airbnb are required to be licensed by the city and must adhere to various regulations, most notably that the property must be someone’s primary residence.

Eric Escudero, communications director for Denver’s Department of Excise and Licenses, said there were 2,580 active licenses as of Feb. 9.

That number was up 21 percent compared to February 2022, he said. And critically, it was slightly more than the previous peak of 2,575 licenses the city reached in March 2020.

“Denver has surpassed the number of active short-term rental licenses that there were when the pandemic struck,” Escudero said in an email. “This signals the tourism industry in Denver may have fully recovered.”

AirDNA, a Denver-based company, collects data on short-term rentals, including pricing trends, demand and revenue. Vice President Jamie Lane said Denver has yet to return to its number of pre-pandemic bookings, but revenue has recovered because the cost of stays has increased. He said prices increased substantially in 2021 and through the first half of 2022.

“If people are paying higher rates, then generally the revenue recovery is going to happen before demand recovery,” Lane said.

Prices in the market began to normalize at the end of the year, with only 6 to 7 percent growth, according to AirDNA data. Lane said this was due to more rentals popping up on the market.

“We’re now sort of catching back up with that pre-pandemic level,” Lane said. “It’s going to take a bit more growth, but I suspect we will get there in 2023.”