The owner of the Nativ Hotel building in downtown Denver has filed for Chapter 11 bankruptcy protection in an effort to slow the foreclosure process — and a nightclub operator currently facing heat from the city wants to move in.

KDA Properties LLC said in its Wednesday filing that it owes $9.61 million to four creditors.

The bulk of the money — $8.07 million — is owed to Chicago-based Pangea Mortgage Capital. The claim is secured by the four-story building Nativ occupies at 1612 Wazee St., as well as other assets. Pangea did not respond to a request for comment.

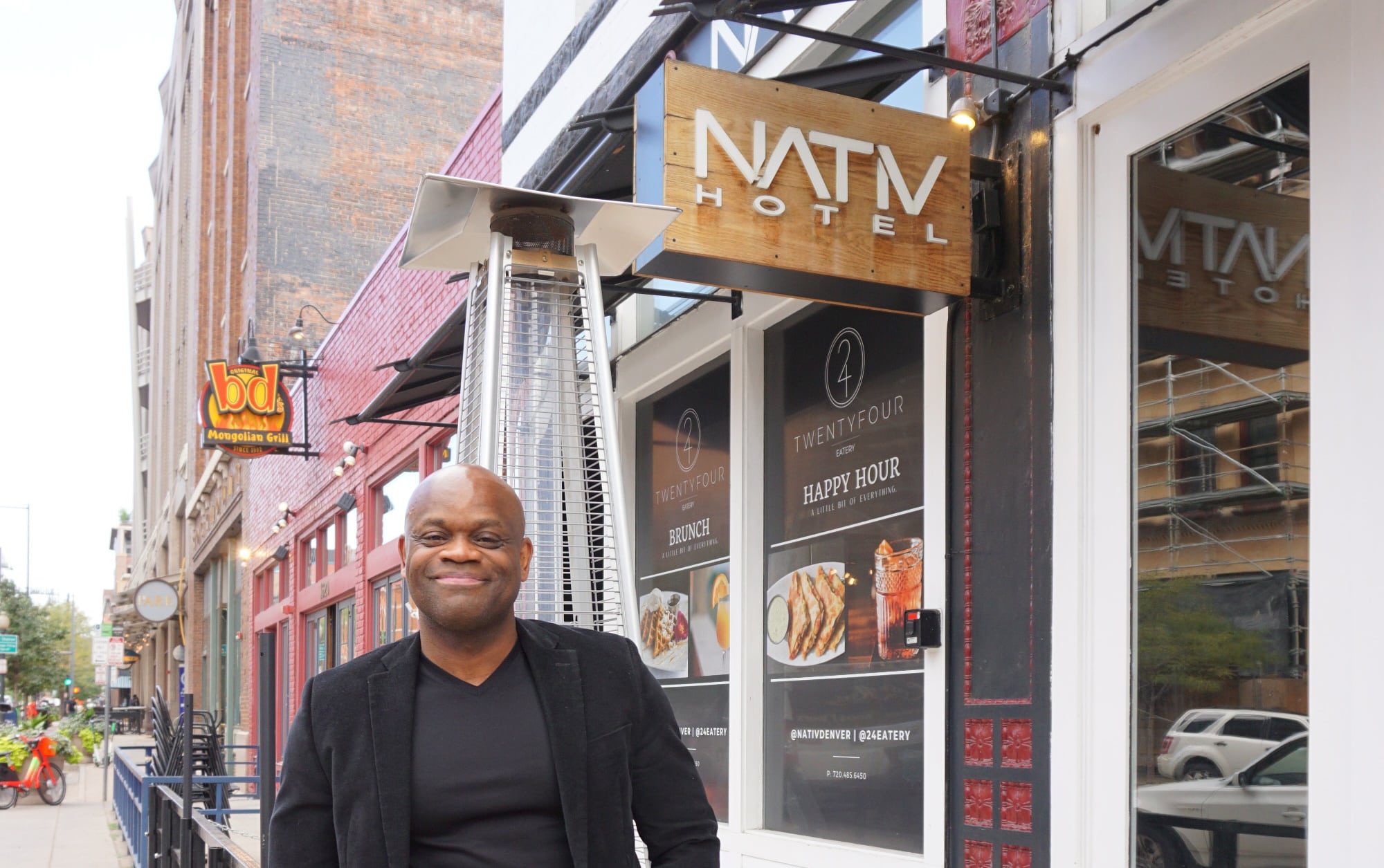

“We’ve recently had the intention to exit the property, but we’re going to exit our way,” said Nativ Hotel co-owner Amin Suliaman. “I’m not going to let them bully us out of the property.”

Companies use Chapter 11 bankruptcy protection to reorganize and help keep the business alive, paying creditors over time.

Suliaman told BusinessDen the bankruptcy filing pertains solely to the business’ real estate. He said the 14-room hotel and attached nightclub are run by a different entity that did not file for bankruptcy.

Pangea Mortgage Capital initiated the foreclosure process for the hotel building in December 2020, according to Denver’s Public Trustee Office. Suliaman said the business was about to receive its PPP funds in January and was “blindsided.”

An auction of the property was initially set for May, but has been repeatedly pushed back. Suliaman said the lender has not set an official date because the business has been making its monthly mortgage payment of $56,000.

“This gives us an opportunity to reset with a neutral third party in the bankruptcy court, and forces our lender to address the plan in place that we have to exit,” Suliaman said. “It gets us back to an even playing field.”

Attorney Jeffrey Weinman of Weinman & Associates is representing Nativ in bankruptcy proceedings.

Building up for sale; hotel largely not operating

In its filing, KDA Properties said it has assets totaling $11.61 million. Of that, $10.8 million is what the company estimates the Wazee Street building is worth.

But Suliaman also said the building is currently on the market with an asking price of $7 million. Skyler Cooper of Marcus & Millichap has the listing.

Hotel operations have been paused since the pandemic began, with the exception of large bookings for nightclub visitors. Suliaman said increasing cleaning costs and an employee shortage has made it more expensive to run the hotel. The nightclub continues to operate.

Suliaman owns 49 percent of KDA Properties. Kenneth Ware, listing a Centennial address, owns the other 51 percent. Ware is also the entity’s second-largest creditor, owed $1.2 million for “capital investment,” according to the filing.

KDA Properties said it has had no revenue this year. It said it made $75,000 in “rental income from Nativ Hotel” in 2020, and $118,613 in 2019.

“You know, we’ve had better investments,” Suliaman said. “This wasn’t our best, but we’ll continue to plug away.”

From marijuana to missed payments

The Nativ Hotel opened in spring 2015, and has had something of a tumultuous existence.

Shortly before Nativ opened in 2015, The Denver Post’s cannabis section dubbed it “central Denver’s first outwardly 420-friendly hotel,” citing balconies where guests could smoke weed, a cafe serving coffee infused with CBD and owners involved in other marijuana-related businesses.

By July 2015, however, the hotel was telling guests they could not use marijuana on the property, according to Westword, which said the move was “reportedly because neighbors and the landlord were surprised by the pro-pot stance.”

Then, in early 2018, the company that had been operating the hotel pulled out, letting its landlord take over control of the business. A couple months later, KDA Properties LLC paid $6.05 million for both the business and its real estate, Suliaman told BusinessDen at the time.

In 2019, Suliaman and KDA Properties were sued by the former owners of the Nativ Hotel, Hotel Denver, LLC, for missing a $5.5 million promissory note payment. The case was later settled.

Beta owner eyes property

Valentes Corleons, the owner of Beta nightclub at 1909 Blake St., posted on social media earlier this month, saying the keys to the hotel would be in his hands once Nativ hit auction.

Suliaman doesn’t want to see that happen.

“I would rather burn this place to the ground than have Valentes take over,” he said.

Suliaman said he believes that a local real estate investor is working with his lender to buy Nativ’s building out of foreclosure and have Corleons operate a business there. That’s another reason he wanted to delay the foreclosure process, he said.

Corleons, however, told BusinessDen Wednesday that while he does want to buy the property, he’s not working with anyone else and hasn’t been in touch with the lender. He said he originally wanted to buy the property years ago, but Suliaman “stole the deal from underneath me.”

“You can’t believe a single word Amin says,” Corleons said.

Beta nightclub is currently facing 10 alleged violations of the Denver municipal code and Colorado state law, including having inadequate security and allowing the distribution of narcotics. The city’s Department of Excise and Licenses will hold a hearing Oct. 18 to determine whether the business should be fined or have its dance cabaret and tavern liquor licenses suspended or revoked.

Corleons’ attorney previously told BusinessDen the alleged violations by his client’s business are a “little exaggerated” and that the owner took big steps to ensure there was adequate security.

In addition to Beta, Corleons owns Purple Martini downtown, and he took over El Chapultepec jazz club when it closed in December after nearly nine decades. He also purchased the 5,184-square-foot building next to Beta — previously home to Falling Rock Tap House — in July for $2.5 million.

The owner of the Nativ Hotel building in downtown Denver has filed for Chapter 11 bankruptcy protection in an effort to slow the foreclosure process — and a nightclub operator currently facing heat from the city wants to move in.

KDA Properties LLC said in its Wednesday filing that it owes $9.61 million to four creditors.

The bulk of the money — $8.07 million — is owed to Chicago-based Pangea Mortgage Capital. The claim is secured by the four-story building Nativ occupies at 1612 Wazee St., as well as other assets. Pangea did not respond to a request for comment.

“We’ve recently had the intention to exit the property, but we’re going to exit our way,” said Nativ Hotel co-owner Amin Suliaman. “I’m not going to let them bully us out of the property.”

Companies use Chapter 11 bankruptcy protection to reorganize and help keep the business alive, paying creditors over time.

Suliaman told BusinessDen the bankruptcy filing pertains solely to the business’ real estate. He said the 14-room hotel and attached nightclub are run by a different entity that did not file for bankruptcy.

Pangea Mortgage Capital initiated the foreclosure process for the hotel building in December 2020, according to Denver’s Public Trustee Office. Suliaman said the business was about to receive its PPP funds in January and was “blindsided.”

An auction of the property was initially set for May, but has been repeatedly pushed back. Suliaman said the lender has not set an official date because the business has been making its monthly mortgage payment of $56,000.

“This gives us an opportunity to reset with a neutral third party in the bankruptcy court, and forces our lender to address the plan in place that we have to exit,” Suliaman said. “It gets us back to an even playing field.”

Attorney Jeffrey Weinman of Weinman & Associates is representing Nativ in bankruptcy proceedings.

Building up for sale; hotel largely not operating

In its filing, KDA Properties said it has assets totaling $11.61 million. Of that, $10.8 million is what the company estimates the Wazee Street building is worth.

But Suliaman also said the building is currently on the market with an asking price of $7 million. Skyler Cooper of Marcus & Millichap has the listing.

Hotel operations have been paused since the pandemic began, with the exception of large bookings for nightclub visitors. Suliaman said increasing cleaning costs and an employee shortage has made it more expensive to run the hotel. The nightclub continues to operate.

Suliaman owns 49 percent of KDA Properties. Kenneth Ware, listing a Centennial address, owns the other 51 percent. Ware is also the entity’s second-largest creditor, owed $1.2 million for “capital investment,” according to the filing.

KDA Properties said it has had no revenue this year. It said it made $75,000 in “rental income from Nativ Hotel” in 2020, and $118,613 in 2019.

“You know, we’ve had better investments,” Suliaman said. “This wasn’t our best, but we’ll continue to plug away.”

From marijuana to missed payments

The Nativ Hotel opened in spring 2015, and has had something of a tumultuous existence.

Shortly before Nativ opened in 2015, The Denver Post’s cannabis section dubbed it “central Denver’s first outwardly 420-friendly hotel,” citing balconies where guests could smoke weed, a cafe serving coffee infused with CBD and owners involved in other marijuana-related businesses.

By July 2015, however, the hotel was telling guests they could not use marijuana on the property, according to Westword, which said the move was “reportedly because neighbors and the landlord were surprised by the pro-pot stance.”

Then, in early 2018, the company that had been operating the hotel pulled out, letting its landlord take over control of the business. A couple months later, KDA Properties LLC paid $6.05 million for both the business and its real estate, Suliaman told BusinessDen at the time.

In 2019, Suliaman and KDA Properties were sued by the former owners of the Nativ Hotel, Hotel Denver, LLC, for missing a $5.5 million promissory note payment. The case was later settled.

Beta owner eyes property

Valentes Corleons, the owner of Beta nightclub at 1909 Blake St., posted on social media earlier this month, saying the keys to the hotel would be in his hands once Nativ hit auction.

Suliaman doesn’t want to see that happen.

“I would rather burn this place to the ground than have Valentes take over,” he said.

Suliaman said he believes that a local real estate investor is working with his lender to buy Nativ’s building out of foreclosure and have Corleons operate a business there. That’s another reason he wanted to delay the foreclosure process, he said.

Corleons, however, told BusinessDen Wednesday that while he does want to buy the property, he’s not working with anyone else and hasn’t been in touch with the lender. He said he originally wanted to buy the property years ago, but Suliaman “stole the deal from underneath me.”

“You can’t believe a single word Amin says,” Corleons said.

Beta nightclub is currently facing 10 alleged violations of the Denver municipal code and Colorado state law, including having inadequate security and allowing the distribution of narcotics. The city’s Department of Excise and Licenses will hold a hearing Oct. 18 to determine whether the business should be fined or have its dance cabaret and tavern liquor licenses suspended or revoked.

Corleons’ attorney previously told BusinessDen the alleged violations by his client’s business are a “little exaggerated” and that the owner took big steps to ensure there was adequate security.

In addition to Beta, Corleons owns Purple Martini downtown, and he took over El Chapultepec jazz club when it closed in December after nearly nine decades. He also purchased the 5,184-square-foot building next to Beta — previously home to Falling Rock Tap House — in July for $2.5 million.