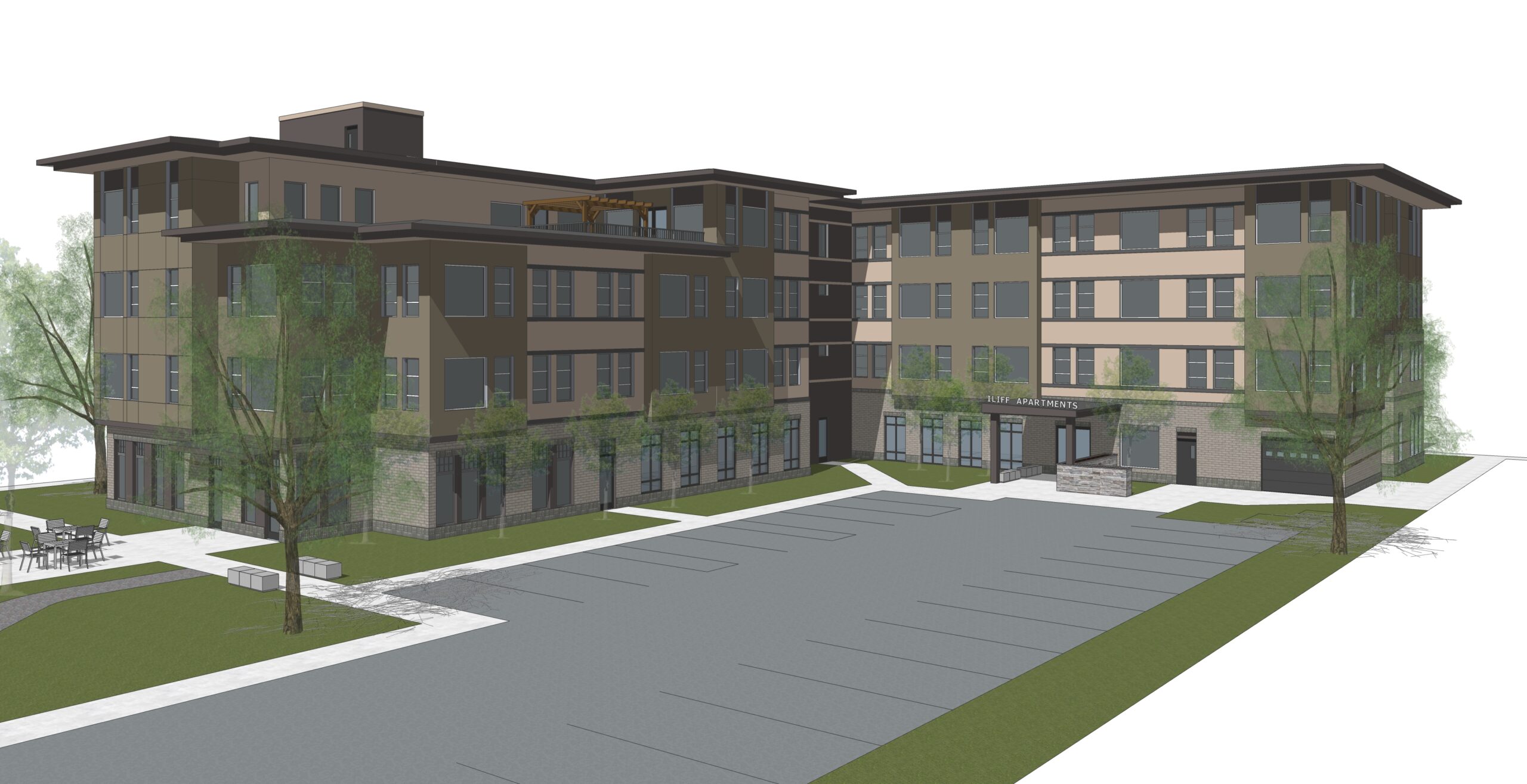

A rendering showing a proposed apartment building at 800 Grant St. in Denver. (Development plans)

Cap Hill and University Hills could trade old offices for new apartments.

Plans for a 76-unit, income-restricted apartment complex for seniors at 800 Grant St. in Cap Hill were submitted by California-based Chelsea Investment Corp. this week.

The site is currently a concrete, six-story office building owned by County Technical Services Inc., an insurance firm with space on the building’s fourth floor. The company did not respond to a request for comment. The structure dates to 1972, according to property records.

The documents call for the office building to be demolished, and a seven-story apartment building to be constructed in its place. A parking garage north of the existing structure would remain.

“This location has many amenities that appeal to a senior population,” Jim Anderson, Chelsea Investment chief development officer, said in an email to BusinessDen.

The office building currently at 800 Grant St. in Denver. (Google Maps)

The first floor would have a 1,350-square-foot lobby and a 720-square-foot amenity space in addition to a courtyard, bike storage and six one-bedroom units. The remaining floors would be purely residential — a mix of one- and two-bedroom apartments averaging 570 and 780 square feet.

Units will be age-restricted and income-restricted to those making 30 percent to 80 percent of the area median income. Andersen said the age limit has not been decided yet. Construction is expected to begin next year, with the first residents moving in about two years after that.

“The current financing plan includes pursuing state tax credits and other sources of subsidy,” he said.

This will be Chelsea’s first Denver development, but the company has 40 years of experience in California and across the southwest, where it’s delivered over 15,000 homes and apartments.

Further east at 4770 E. Iliff Ave. in the University Hills neighborhood, a similar project is a bit further along. Denver-based MGL Partners snapped up the old office building there on a lot slightly larger than 1 acre for $2.7 million, according to public records. The income-restricted housing developer will knock down the existing structure and build 50 apartments for those 62 and older in its place.

In May, MGL’s project was awarded a $1.45 million nine percent tax credit by the Colorado Housing and Finance Authority. The four-story building will begin construction next spring.

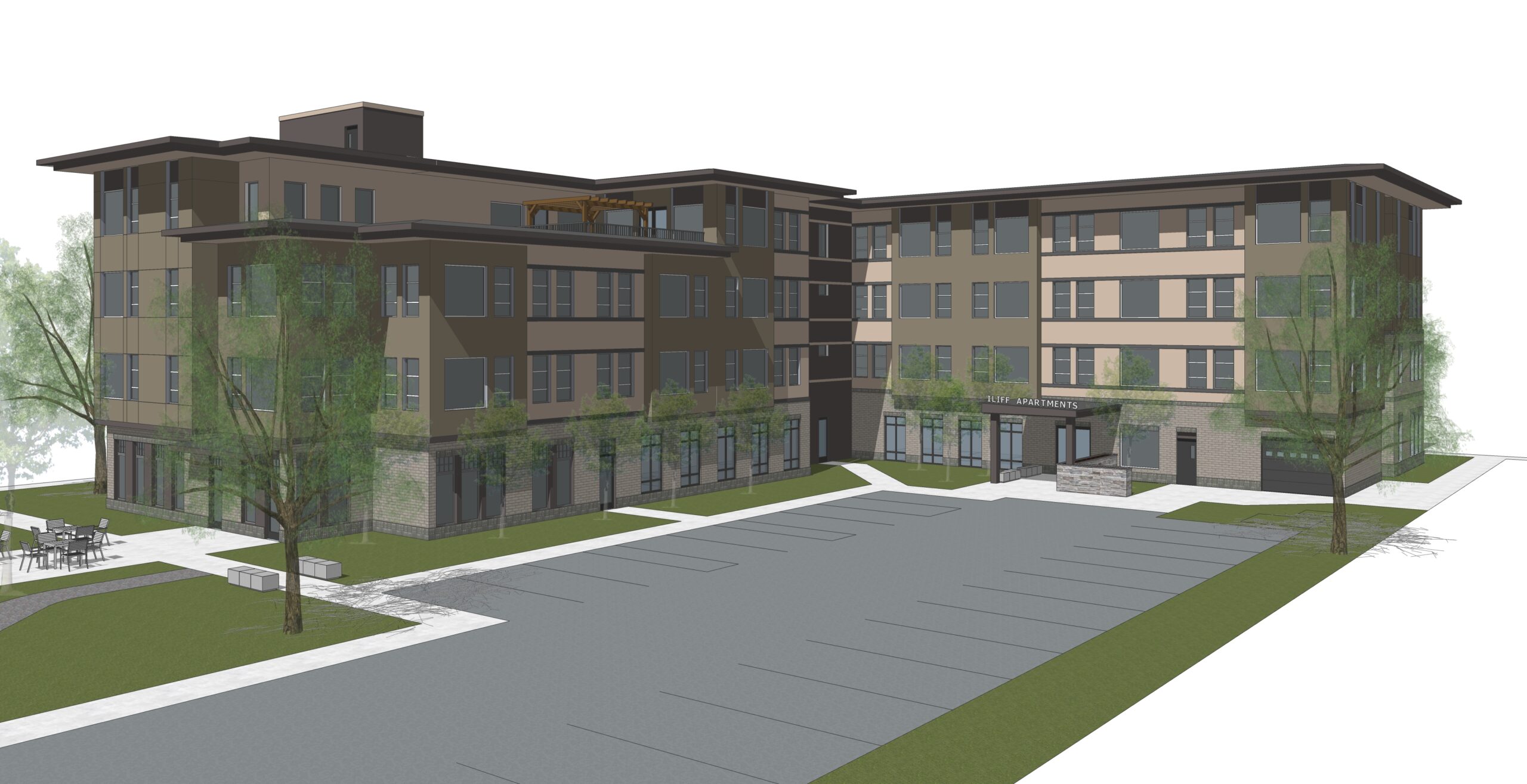

A rendering of MGL Partners’ planned apartment complex at 4770 E. Iliff Ave. in Denver. (Courtesy MGL Partners)

Bill van Doorninck, president of the office condo association that sold the Iliff building, said selling it was “the most profitable choice.”

“You may not be surprised that office space is kind of a downer right now, low demand … the value of our property was much greater if we sold to someone who wanted to develop affordable housing,” he said.

The 83-year-old retired psychologist had his offices there since the building’s completion in 1982. It was originally constructed to house space for those working in conjunction with the nearby Bethesda Hospital at 4400 E. Iliff Ave., now the site of Denver Academy, a private school.

The building was designed so that each office was its own condo to be bought and sold. At its inception, there were 34 condo owners in the building, one for each office. In the past 40 years, it shrunk to just 15 as many practitioners retired or moved due to a changing medical services industry that made it harder for one-off private practices to succeed, van Doorninck said.

The building hit the market four years ago.

“Many of us were not interested in being landlords anymore,” van Doorninck said. “We wanted to divest and not have the building in the hands of our beneficiaries when we die, because that would be a mess.”

A rendering showing a proposed apartment building at 800 Grant St. in Denver. (Development plans)

Cap Hill and University Hills could trade old offices for new apartments.

Plans for a 76-unit, income-restricted apartment complex for seniors at 800 Grant St. in Cap Hill were submitted by California-based Chelsea Investment Corp. this week.

The site is currently a concrete, six-story office building owned by County Technical Services Inc., an insurance firm with space on the building’s fourth floor. The company did not respond to a request for comment. The structure dates to 1972, according to property records.

The documents call for the office building to be demolished, and a seven-story apartment building to be constructed in its place. A parking garage north of the existing structure would remain.

“This location has many amenities that appeal to a senior population,” Jim Anderson, Chelsea Investment chief development officer, said in an email to BusinessDen.

The office building currently at 800 Grant St. in Denver. (Google Maps)

The first floor would have a 1,350-square-foot lobby and a 720-square-foot amenity space in addition to a courtyard, bike storage and six one-bedroom units. The remaining floors would be purely residential — a mix of one- and two-bedroom apartments averaging 570 and 780 square feet.

Units will be age-restricted and income-restricted to those making 30 percent to 80 percent of the area median income. Andersen said the age limit has not been decided yet. Construction is expected to begin next year, with the first residents moving in about two years after that.

“The current financing plan includes pursuing state tax credits and other sources of subsidy,” he said.

This will be Chelsea’s first Denver development, but the company has 40 years of experience in California and across the southwest, where it’s delivered over 15,000 homes and apartments.

Further east at 4770 E. Iliff Ave. in the University Hills neighborhood, a similar project is a bit further along. Denver-based MGL Partners snapped up the old office building there on a lot slightly larger than 1 acre for $2.7 million, according to public records. The income-restricted housing developer will knock down the existing structure and build 50 apartments for those 62 and older in its place.

In May, MGL’s project was awarded a $1.45 million nine percent tax credit by the Colorado Housing and Finance Authority. The four-story building will begin construction next spring.

A rendering of MGL Partners’ planned apartment complex at 4770 E. Iliff Ave. in Denver. (Courtesy MGL Partners)

Bill van Doorninck, president of the office condo association that sold the Iliff building, said selling it was “the most profitable choice.”

“You may not be surprised that office space is kind of a downer right now, low demand … the value of our property was much greater if we sold to someone who wanted to develop affordable housing,” he said.

The 83-year-old retired psychologist had his offices there since the building’s completion in 1982. It was originally constructed to house space for those working in conjunction with the nearby Bethesda Hospital at 4400 E. Iliff Ave., now the site of Denver Academy, a private school.

The building was designed so that each office was its own condo to be bought and sold. At its inception, there were 34 condo owners in the building, one for each office. In the past 40 years, it shrunk to just 15 as many practitioners retired or moved due to a changing medical services industry that made it harder for one-off private practices to succeed, van Doorninck said.

The building hit the market four years ago.

“Many of us were not interested in being landlords anymore,” van Doorninck said. “We wanted to divest and not have the building in the hands of our beneficiaries when we die, because that would be a mess.”