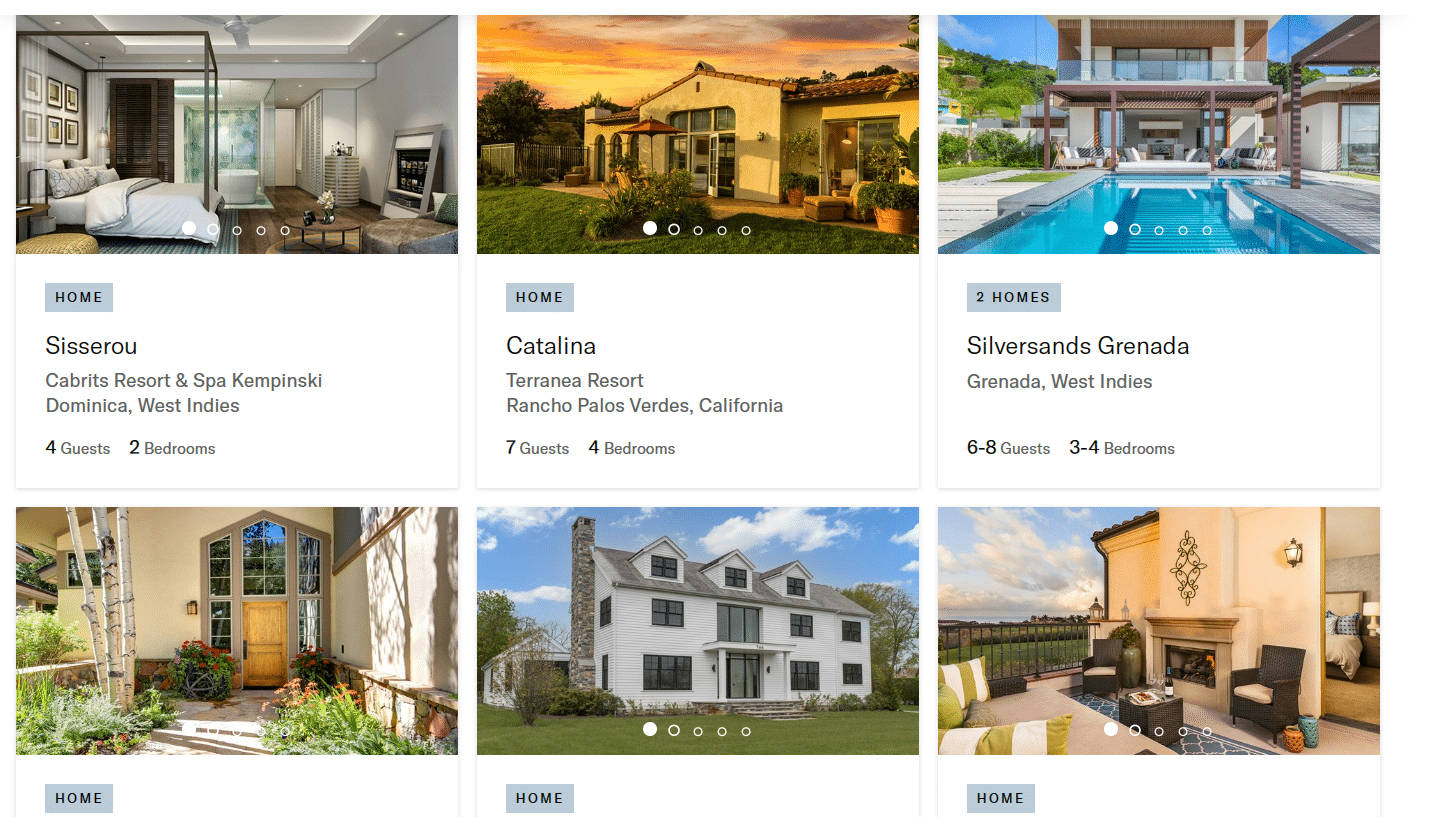

A handful of the properties listed on Inspirato’s website. (BusinessDen file)

Inspirato, the publicly traded travel club based in Denver, could be delisted from the Nasdaq due to its plummeting stock price.

In November, the stock exchange warned the company it risked being booted because its market capitalization — or total value of its public shares — had fallen below a $15 million threshold. The company gave Inspirato 180 days to get back in compliance.

On Thursday, Nasdaq sent a follow-up notice, saying the company was still below the threshold. Inspirato has until Thursday to file an appeal or its public securities will be suspended on June 10, according to an SEC filing.

The company said in a filing that it plans to appeal. Inspirato’s market capitalization as of closing Monday was $13.8 million, according to the Nasdaq’s website.

This is not the first time Inspirato has received notice of noncompliance from the stock exchange. In November 2022, the company received notice after failing to file its quarterly financial statement on time for that quarter. The company again received notice in May 2023 because its share price was under $1 for 30 days.

Inspirato addressed the latter with a 1-to-20 reverse stock split in October.

Inspirato leases high-end vacation homes for its members, who pay anywhere between $650 and $2,550 a month. Inspirato has struggled since going public in February 2022 through a SPAC deal merger.

The company’s stock surged when first going public but has rapidly declined since then. Over the past year, Inspirato’s stock has continued to drop steadily. Between April 30 and May 30, the company’s closing price did not exceed $4.10. On Monday, Inspirato’s stock closed at just over $4.

Inspirato’s 2023 revenue was $329. million, down about 5 percent from 2022. Inspirato was down about 4.3 percent in revenue from travel and about 5.5 percent in revenue from subscriptions.

Inspirato’s revenue in the first quarter of 2024 was down more than 14 percent from last year. The company said it did boost its occupancy rate, from 77 percent in the first quarter of 2023 to 80 percent in 2024.

Last year, Inspirato began listing some of its homes on Airbnb, making them available to anyone and not just the club’s members. To boost revenue, Inspirato also started Inspirato for Good and Inspirato for Business.

In September, Inspirato appointed Eric Grosse as CEO as Brent Handler, who co-founded the company, resigned from the role.

Chief Financial Officer Robert Kaiden said in a press release about Inspirato’s first quarter financial statements that the company expects losses and fluctuations over the year, attributing that to the seasonality of the business.

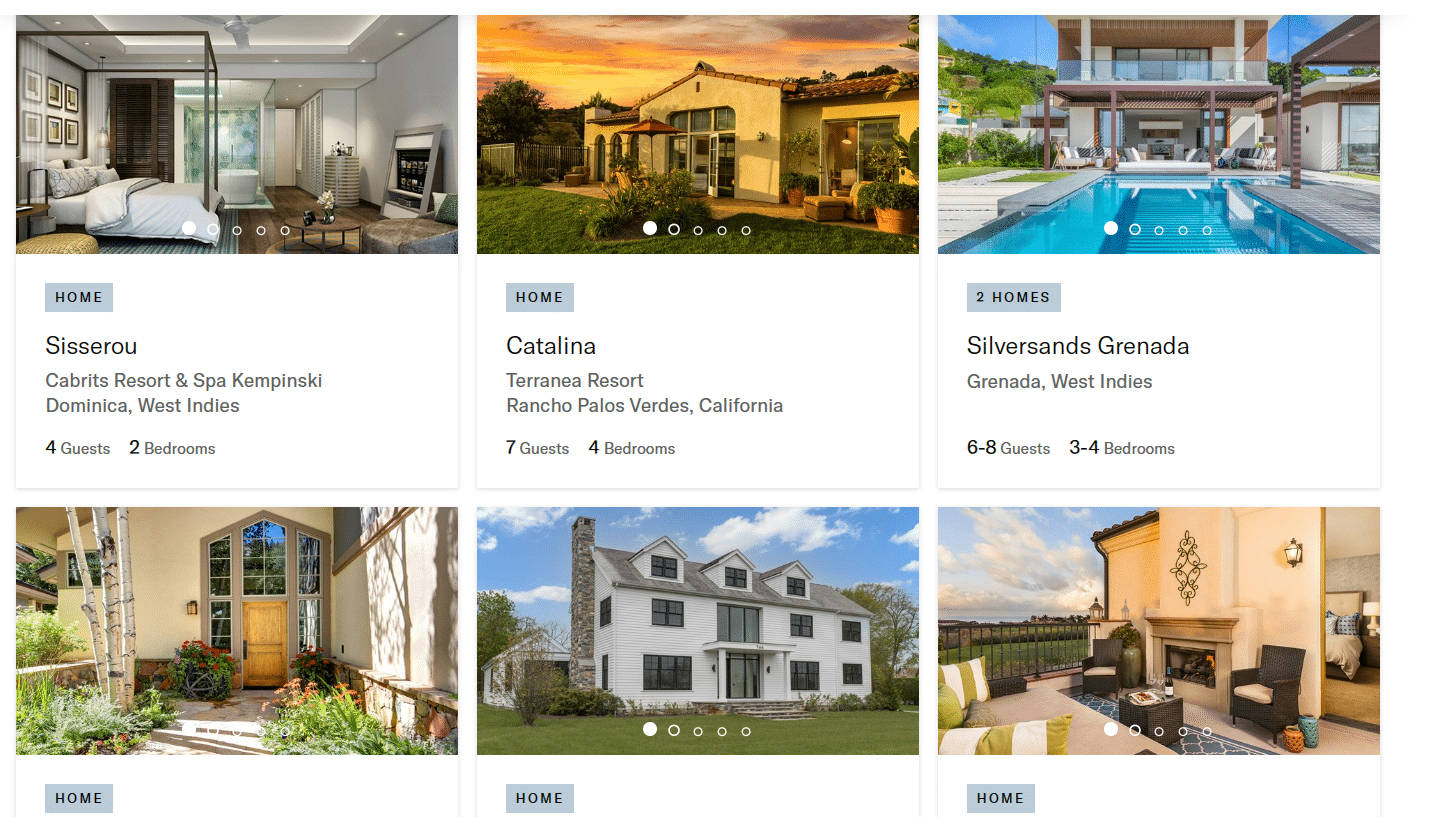

A handful of the properties listed on Inspirato’s website. (BusinessDen file)

Inspirato, the publicly traded travel club based in Denver, could be delisted from the Nasdaq due to its plummeting stock price.

In November, the stock exchange warned the company it risked being booted because its market capitalization — or total value of its public shares — had fallen below a $15 million threshold. The company gave Inspirato 180 days to get back in compliance.

On Thursday, Nasdaq sent a follow-up notice, saying the company was still below the threshold. Inspirato has until Thursday to file an appeal or its public securities will be suspended on June 10, according to an SEC filing.

The company said in a filing that it plans to appeal. Inspirato’s market capitalization as of closing Monday was $13.8 million, according to the Nasdaq’s website.

This is not the first time Inspirato has received notice of noncompliance from the stock exchange. In November 2022, the company received notice after failing to file its quarterly financial statement on time for that quarter. The company again received notice in May 2023 because its share price was under $1 for 30 days.

Inspirato addressed the latter with a 1-to-20 reverse stock split in October.

Inspirato leases high-end vacation homes for its members, who pay anywhere between $650 and $2,550 a month. Inspirato has struggled since going public in February 2022 through a SPAC deal merger.

The company’s stock surged when first going public but has rapidly declined since then. Over the past year, Inspirato’s stock has continued to drop steadily. Between April 30 and May 30, the company’s closing price did not exceed $4.10. On Monday, Inspirato’s stock closed at just over $4.

Inspirato’s 2023 revenue was $329. million, down about 5 percent from 2022. Inspirato was down about 4.3 percent in revenue from travel and about 5.5 percent in revenue from subscriptions.

Inspirato’s revenue in the first quarter of 2024 was down more than 14 percent from last year. The company said it did boost its occupancy rate, from 77 percent in the first quarter of 2023 to 80 percent in 2024.

Last year, Inspirato began listing some of its homes on Airbnb, making them available to anyone and not just the club’s members. To boost revenue, Inspirato also started Inspirato for Good and Inspirato for Business.

In September, Inspirato appointed Eric Grosse as CEO as Brent Handler, who co-founded the company, resigned from the role.

Chief Financial Officer Robert Kaiden said in a press release about Inspirato’s first quarter financial statements that the company expects losses and fluctuations over the year, attributing that to the seasonality of the business.