Inside the former Sears at 10785 W. Colfax Ave. in Lakewood. (Courtesy Lakewood Reinvestment Authority)

Lakewood isn’t shying away from the wrecking ball.

The western suburb approved its second-ever demolition loan last week, this time for the former Sears at 10785 W. Colfax Ave.

Austin, Texas-based Artesia Real Estate Investments, which also owns the Westland Town Center retail complex next door to the Sears site, bought the 7.6-acre lot in 2022 for $14 million.

The site, which includes nearly 164,000 square feet across two buildings, plus a small shack, has been vacant since Sears closed its retail store and auto service center in 2018. Artesia plans to eventually turn both the Sears and Westland Town Center properties into one large mixed-use development.

But, Artesia founder Colin Brothers said they didn’t plan on all the troubles – and expenses – that come with owning a vacant building in Lakewood.

The Sears store closed at the end of 2018. (Google Street View)

“We initially did not have security on the building when we first bought it and that first winter we had a tremendous amount of break-ins, a lot of vandalism, minor theft, just a lot of very shady things going on,” Brothers said, adding he didn’t want to go into the details of how bad it was.

Brothers said Artesia ended up installing security cameras, put a fence up around the property and hired 24-hour private security. He said the firm now spends roughly $40,000 a month on security.

“It’s crazy. We didn’t anticipate that,” Brothers said. “It was a lot of money, but we had to do it, otherwise we would have invited more and more people … there’s liability concerns.”

The city-affiliated Lakewood Reinvestment Authority, or LRA, last week agreed to loan the real estate firm up to $2.75 million to demolish the buildings. Demolition will start next month, and hopefully eliminate the draw of the property to trespassers.

“Now that we have the funds we want to hit go,” Brothers said.

The firm has to pay the $2.75 million back either when it receives funding or permits for redevelopment, or by July 1, 2028.

The loan is part of Lakewood’s “distressed properties program,” which the city launched last year to address dilapidated, blighted and vacant buildings. The program kicked off last summer with a similar demolition loan that allowed developers of the long-vacant shopping center at 10th Avenue and Sheridan Boulevard to tear it down.

In November and March, the LRA demolished two former motels it had purchased, which had become magnets for crime.

In January, Lakewood also enacted an ordinance that requires owners of vacant buildings within the suburb to pay a $700 “registration fee” every six months, and an $800 fee every time emergency services are called to the vacant property.

The goal is to encourage redevelopment of vacant sites and ease some of the costs and resources they require of city employees. Economic Director Robert Smith emphasized at the Lakewood Reinvestment Authority meeting that undeveloped lots are much more manageable than vacant buildings, which tend to be a magnet for crimes.

“As I’ve said many times before, vacant buildings are bad, vacant properties are much better,” Smith said. “The public benefit we’re really getting here is time without the blighted structures in our community.”

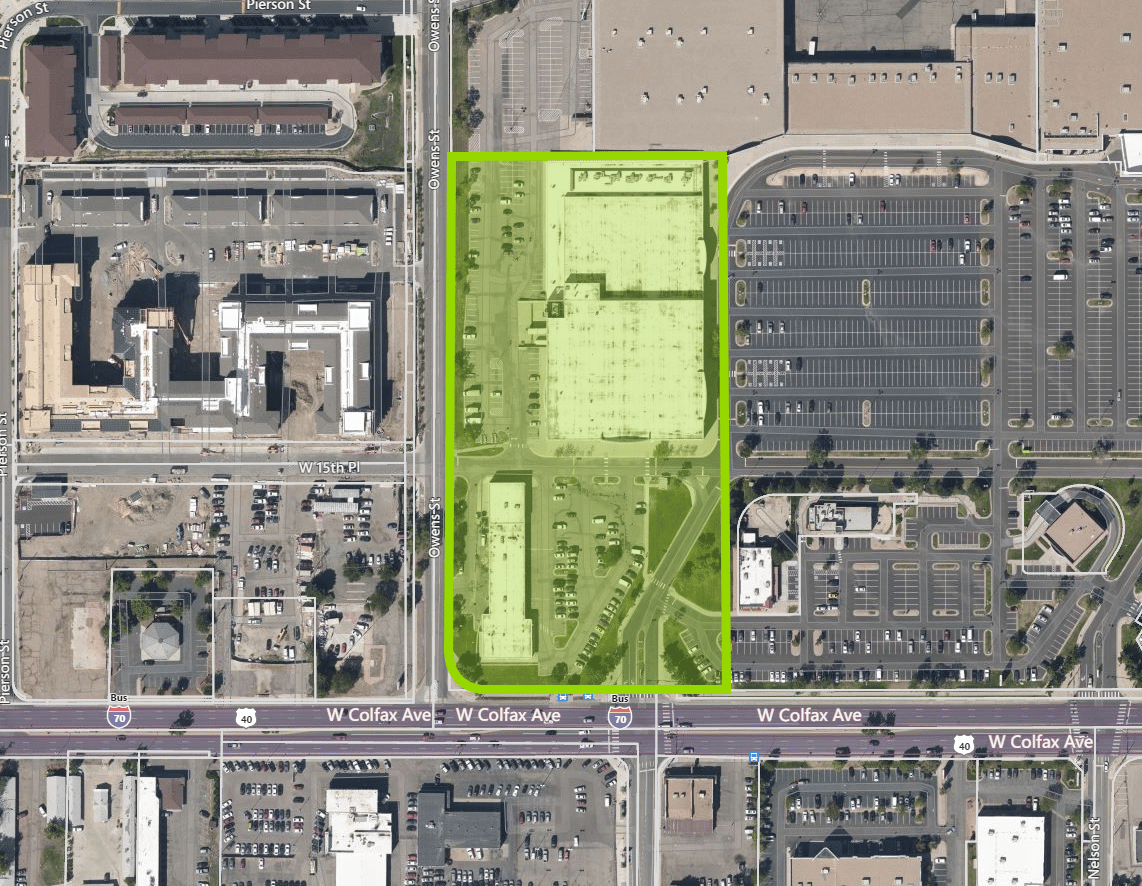

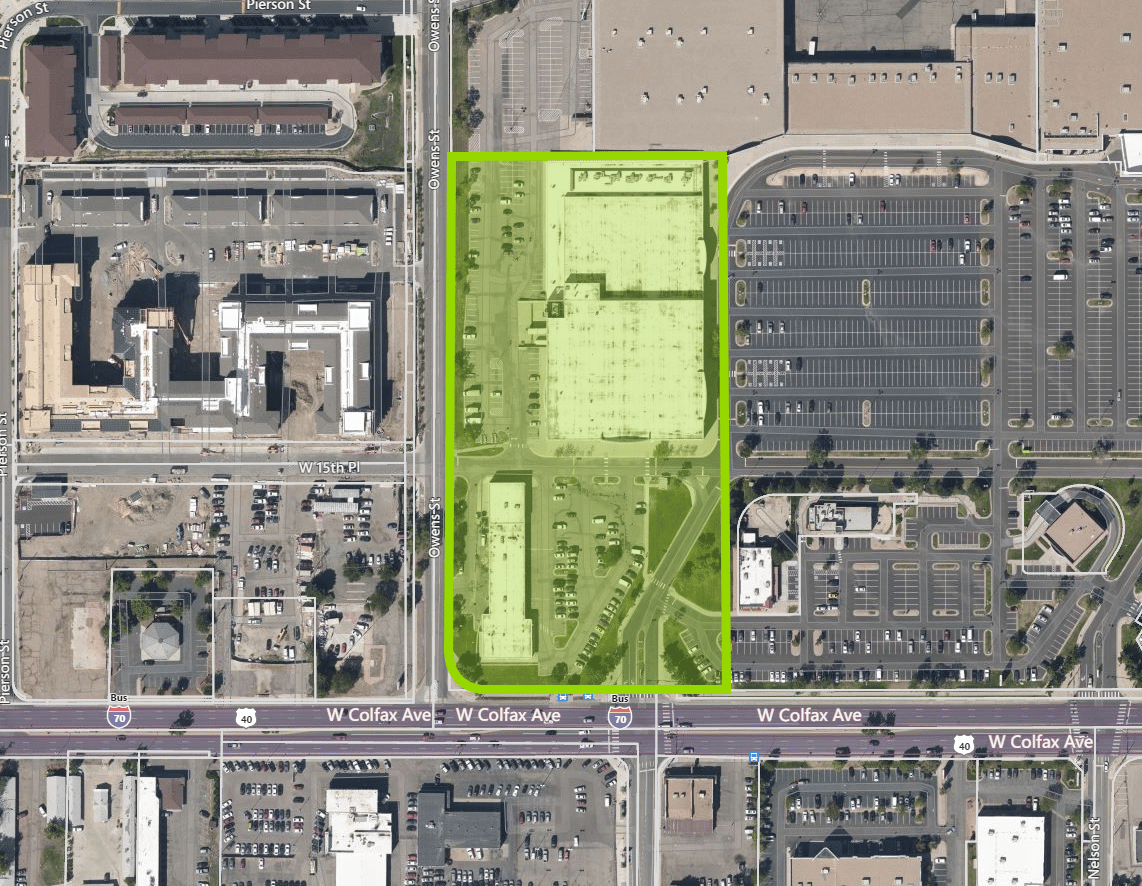

A map showing the boundaries of the former Sears property that Artesia purchased. (Courtesy Capstone)

Inside the former Sears at 10785 W. Colfax Ave. in Lakewood. (Courtesy Lakewood Reinvestment Authority)

Lakewood isn’t shying away from the wrecking ball.

The western suburb approved its second-ever demolition loan last week, this time for the former Sears at 10785 W. Colfax Ave.

Austin, Texas-based Artesia Real Estate Investments, which also owns the Westland Town Center retail complex next door to the Sears site, bought the 7.6-acre lot in 2022 for $14 million.

The site, which includes nearly 164,000 square feet across two buildings, plus a small shack, has been vacant since Sears closed its retail store and auto service center in 2018. Artesia plans to eventually turn both the Sears and Westland Town Center properties into one large mixed-use development.

But, Artesia founder Colin Brothers said they didn’t plan on all the troubles – and expenses – that come with owning a vacant building in Lakewood.

The Sears store closed at the end of 2018. (Google Street View)

“We initially did not have security on the building when we first bought it and that first winter we had a tremendous amount of break-ins, a lot of vandalism, minor theft, just a lot of very shady things going on,” Brothers said, adding he didn’t want to go into the details of how bad it was.

Brothers said Artesia ended up installing security cameras, put a fence up around the property and hired 24-hour private security. He said the firm now spends roughly $40,000 a month on security.

“It’s crazy. We didn’t anticipate that,” Brothers said. “It was a lot of money, but we had to do it, otherwise we would have invited more and more people … there’s liability concerns.”

The city-affiliated Lakewood Reinvestment Authority, or LRA, last week agreed to loan the real estate firm up to $2.75 million to demolish the buildings. Demolition will start next month, and hopefully eliminate the draw of the property to trespassers.

“Now that we have the funds we want to hit go,” Brothers said.

The firm has to pay the $2.75 million back either when it receives funding or permits for redevelopment, or by July 1, 2028.

The loan is part of Lakewood’s “distressed properties program,” which the city launched last year to address dilapidated, blighted and vacant buildings. The program kicked off last summer with a similar demolition loan that allowed developers of the long-vacant shopping center at 10th Avenue and Sheridan Boulevard to tear it down.

In November and March, the LRA demolished two former motels it had purchased, which had become magnets for crime.

In January, Lakewood also enacted an ordinance that requires owners of vacant buildings within the suburb to pay a $700 “registration fee” every six months, and an $800 fee every time emergency services are called to the vacant property.

The goal is to encourage redevelopment of vacant sites and ease some of the costs and resources they require of city employees. Economic Director Robert Smith emphasized at the Lakewood Reinvestment Authority meeting that undeveloped lots are much more manageable than vacant buildings, which tend to be a magnet for crimes.

“As I’ve said many times before, vacant buildings are bad, vacant properties are much better,” Smith said. “The public benefit we’re really getting here is time without the blighted structures in our community.”

A map showing the boundaries of the former Sears property that Artesia purchased. (Courtesy Capstone)