Holy Ground Tiny Homes founder Matt Sowash looks on during a civil trial in Arapahoe County District Court on Monday, April 22, 2024. (Justin Wingerter/BusinessDen)

A judge in Centennial is weighing whether the sole owner of a tiny home construction company can be held personally liable for the alleged theft of a customer’s deposit.

His decision will be the first court verdict regarding Holy Ground Tiny Homes in Englewood, which took $6 million in deposits from 180 customers who never received houses. Last year, an investigation found that some of the cash was spent on trips to Las Vegas, limousine rides, spas and two dozen vehicles. Some other money could not be accounted for.

Matt Sowash is owned and operated by Matt Sowash, who served nearly two years in prison in the 2000s for stealing $470,000 from investors in a poker league and Vegas poker tournament. On Monday, Sowash fielded questions about Holy Ground from the witness stand.

“Holy Ground used this money for some purpose other than the construction of a house, isn’t that right?” attorney Paul Grant asked about one customer’s deposit.

“Just the general operations of the business,” Sowash testified under oath.

“But you’re not sure, are you? You can’t say where this $35,000 went, right?”

“That is right,” Sowash conceded.

Grant represents a North Carolina woman named Morgan Daniels, who also testified at Monday’s half-day civil trial. She paid a 100% deposit of $35,248 to Holy Ground in 2021 and was promised her tiny home would arrive in six months. It didn’t, she demanded a refund, got $11,000 back and then sued Sowash for theft when she was denied the rest.

“You authorized a trip to Las Vegas for you and Holy Ground employees, is that right?”

“Yes,” Sowash responded, claiming it was one trip for 18 employees that cost $20,000. Last year’s investigation found several Vegas trips costing about $55,000.

“You could have used that $20,000 to repay Ms. Daniels but you chose not to, right?”

“I chose to give our employees a benefit, yes,” Sowash told Grant.

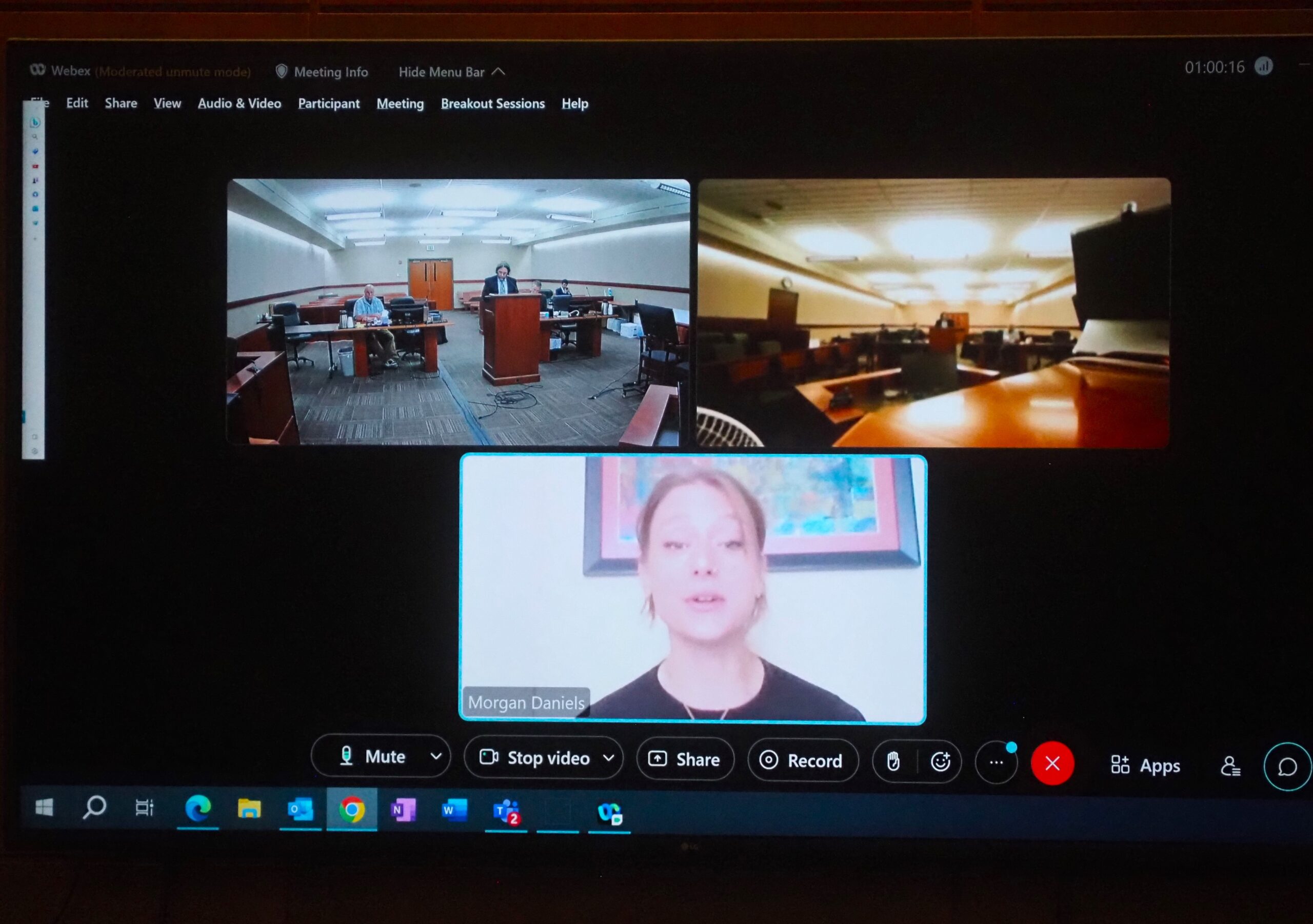

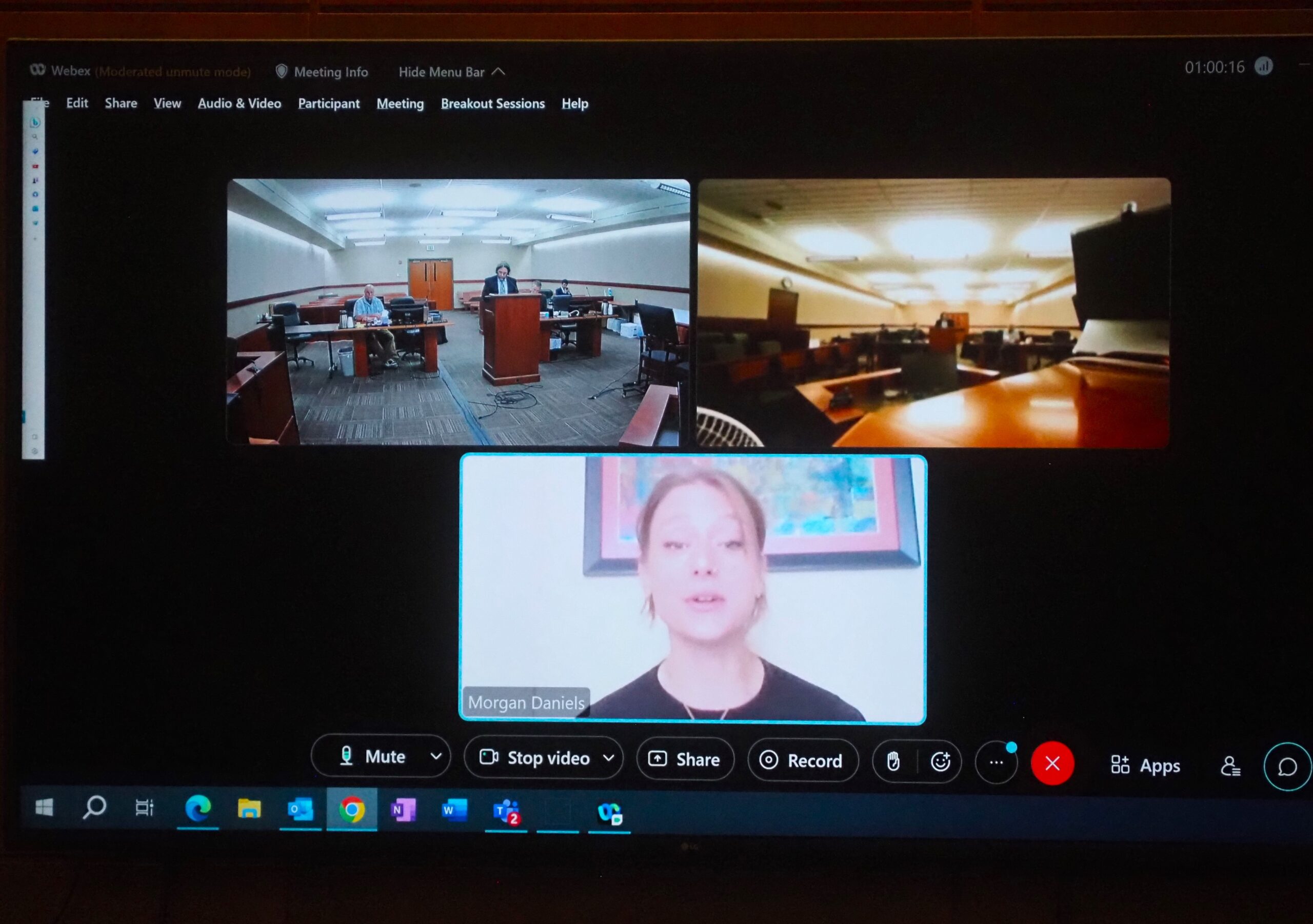

Morgan Daniels, at bottom, testifies virtually during the civil trial of Matt Sowash on Monday, April 22, 2024. (Justin Wingerter/BusinessDen)

Sowash defended spending his customers’ deposits on two dozen vehicles — six motorcycles, three race cars, three classics from 1959 and a limo among them — by explaining that Holy Ground was running a side business as a used car dealership. Customer deposits are used for general business operations, not construction of specific homes, he said.

Sowash also claimed that the deposits might not have been deposits at all but rather investments or even donations, since Holy Ground was initially established as a Christian ministry. (After filing for bankruptcy, it agreed to convert to a corporation).

“It’s a donation if you give money to a nonprofit,” Sowash testified Monday morning.

Daniels, testifying virtually, was asked, “Did you make a donation to Holy Ground?”

“I did not,” she said from her home in North Carolina.

“What did you think you were paying for when you paid Holy Ground $35,000?”

“A tiny house,” Daniels explained, and then added, “My tiny house, specifically.”

When asked by his own attorney, Brian DeBauche, why Holy Ground slid millions of dollars into debt and filed for bankruptcy in fall 2022, Sowash blamed BusinessDen’s reporting in August 2022 that the company was taking deposits and not delivering homes.

DeBauche noted that Daniels is a creditor in the bankruptcy case. Under a plan approved by a bankruptcy judge earlier this year, Holy Ground is supposed to make quarterly payments to her and 180 other customers totaling $3.8 million over five years, and starting soon.

“There is no guarantee that any creditors, including Ms. Daniels, will be paid a cent, correct?” Grant asked Sowash while he was on the witness stand this week.

“I have to start making payments to all creditors in July and that’s what I’m going to do.”

Holy Ground Tiny Homes founder Matt Sowash, center, listens to testimony during a trial in Arapahoe County District Court on Monday, April 22, 2024. His attorney, Brian DeBauche, is in the foreground. (Justin Wingerter/BusinessDen)

In the meantime, Arapahoe County District Court Judge Don Toussaint expects to decide in the next week or two whether Sowash stole $24,000 from Daniels. If he did, Sowash will be ordered to pay three times the amount that he took under the state’s civil theft statute.

“He used Ms. Daniels’ money for some other purpose,” Grant told the judge during closing arguments Monday. “Mr. Sowash doesn’t even know what it was used for because they didn’t keep track. Apparently they just put it in an account and used it for whatever.”

“But it doesn’t really matter how it was used,” Grant claimed a short time later. “What matters is that it was used inconsistent with her intentions for that money.”

DeBauche argued otherwise. Daniels’ deposit, which he called “an investment in a ministry,” must be refunded but there is no time limit on that refund, he said. And since Sowash didn’t personally benefit from the deposit, he can’t be held liable, DeBauche said.

“Ms. Daniels’ remedy is against the company,” he said. “Entirely against the company.”

Holy Ground Tiny Homes founder Matt Sowash looks on during a civil trial in Arapahoe County District Court on Monday, April 22, 2024. (Justin Wingerter/BusinessDen)

A judge in Centennial is weighing whether the sole owner of a tiny home construction company can be held personally liable for the alleged theft of a customer’s deposit.

His decision will be the first court verdict regarding Holy Ground Tiny Homes in Englewood, which took $6 million in deposits from 180 customers who never received houses. Last year, an investigation found that some of the cash was spent on trips to Las Vegas, limousine rides, spas and two dozen vehicles. Some other money could not be accounted for.

Matt Sowash is owned and operated by Matt Sowash, who served nearly two years in prison in the 2000s for stealing $470,000 from investors in a poker league and Vegas poker tournament. On Monday, Sowash fielded questions about Holy Ground from the witness stand.

“Holy Ground used this money for some purpose other than the construction of a house, isn’t that right?” attorney Paul Grant asked about one customer’s deposit.

“Just the general operations of the business,” Sowash testified under oath.

“But you’re not sure, are you? You can’t say where this $35,000 went, right?”

“That is right,” Sowash conceded.

Grant represents a North Carolina woman named Morgan Daniels, who also testified at Monday’s half-day civil trial. She paid a 100% deposit of $35,248 to Holy Ground in 2021 and was promised her tiny home would arrive in six months. It didn’t, she demanded a refund, got $11,000 back and then sued Sowash for theft when she was denied the rest.

“You authorized a trip to Las Vegas for you and Holy Ground employees, is that right?”

“Yes,” Sowash responded, claiming it was one trip for 18 employees that cost $20,000. Last year’s investigation found several Vegas trips costing about $55,000.

“You could have used that $20,000 to repay Ms. Daniels but you chose not to, right?”

“I chose to give our employees a benefit, yes,” Sowash told Grant.

Morgan Daniels, at bottom, testifies virtually during the civil trial of Matt Sowash on Monday, April 22, 2024. (Justin Wingerter/BusinessDen)

Sowash defended spending his customers’ deposits on two dozen vehicles — six motorcycles, three race cars, three classics from 1959 and a limo among them — by explaining that Holy Ground was running a side business as a used car dealership. Customer deposits are used for general business operations, not construction of specific homes, he said.

Sowash also claimed that the deposits might not have been deposits at all but rather investments or even donations, since Holy Ground was initially established as a Christian ministry. (After filing for bankruptcy, it agreed to convert to a corporation).

“It’s a donation if you give money to a nonprofit,” Sowash testified Monday morning.

Daniels, testifying virtually, was asked, “Did you make a donation to Holy Ground?”

“I did not,” she said from her home in North Carolina.

“What did you think you were paying for when you paid Holy Ground $35,000?”

“A tiny house,” Daniels explained, and then added, “My tiny house, specifically.”

When asked by his own attorney, Brian DeBauche, why Holy Ground slid millions of dollars into debt and filed for bankruptcy in fall 2022, Sowash blamed BusinessDen’s reporting in August 2022 that the company was taking deposits and not delivering homes.

DeBauche noted that Daniels is a creditor in the bankruptcy case. Under a plan approved by a bankruptcy judge earlier this year, Holy Ground is supposed to make quarterly payments to her and 180 other customers totaling $3.8 million over five years, and starting soon.

“There is no guarantee that any creditors, including Ms. Daniels, will be paid a cent, correct?” Grant asked Sowash while he was on the witness stand this week.

“I have to start making payments to all creditors in July and that’s what I’m going to do.”

Holy Ground Tiny Homes founder Matt Sowash, center, listens to testimony during a trial in Arapahoe County District Court on Monday, April 22, 2024. His attorney, Brian DeBauche, is in the foreground. (Justin Wingerter/BusinessDen)

In the meantime, Arapahoe County District Court Judge Don Toussaint expects to decide in the next week or two whether Sowash stole $24,000 from Daniels. If he did, Sowash will be ordered to pay three times the amount that he took under the state’s civil theft statute.

“He used Ms. Daniels’ money for some other purpose,” Grant told the judge during closing arguments Monday. “Mr. Sowash doesn’t even know what it was used for because they didn’t keep track. Apparently they just put it in an account and used it for whatever.”

“But it doesn’t really matter how it was used,” Grant claimed a short time later. “What matters is that it was used inconsistent with her intentions for that money.”

DeBauche argued otherwise. Daniels’ deposit, which he called “an investment in a ministry,” must be refunded but there is no time limit on that refund, he said. And since Sowash didn’t personally benefit from the deposit, he can’t be held liable, DeBauche said.

“Ms. Daniels’ remedy is against the company,” he said. “Entirely against the company.”