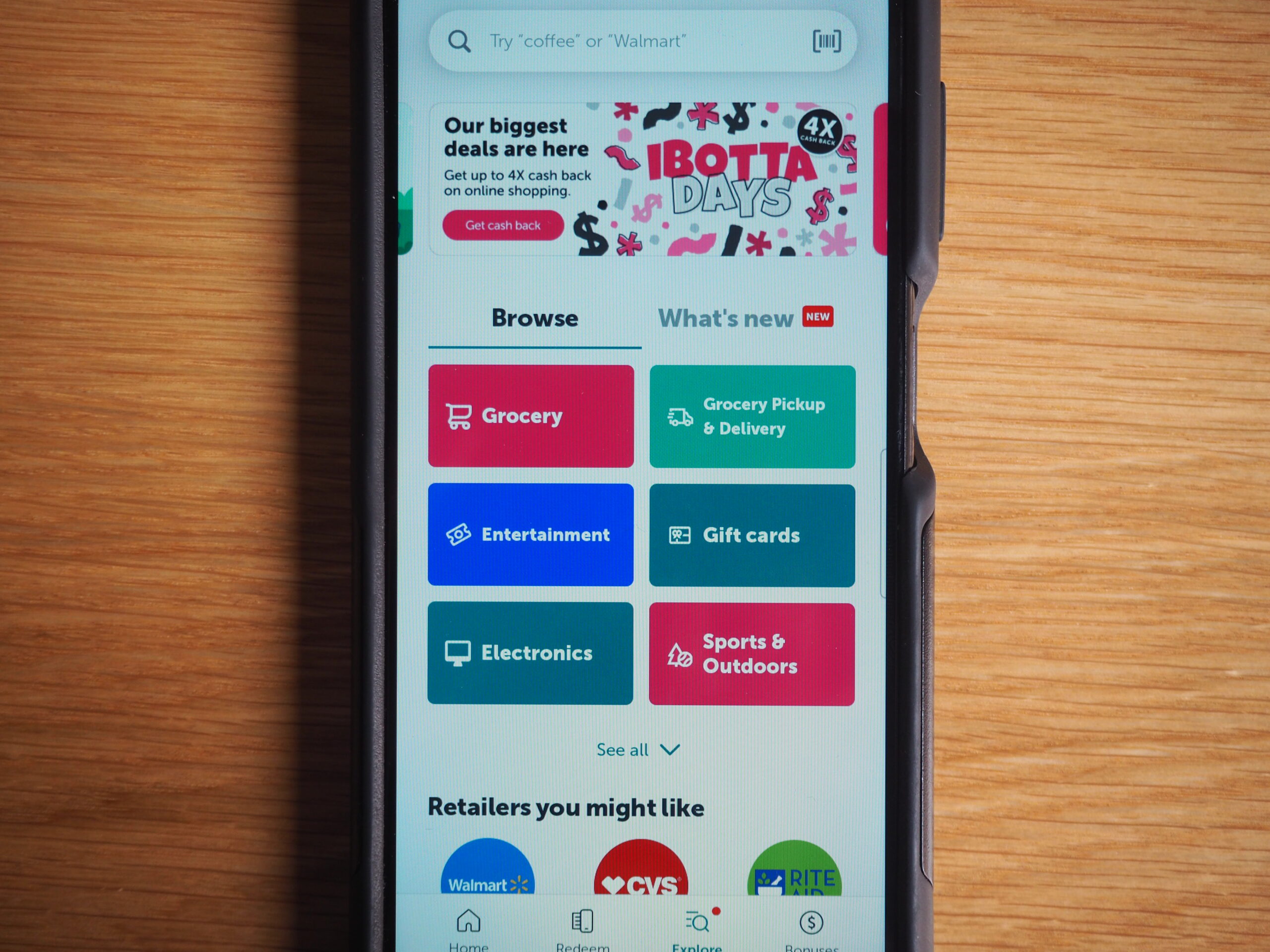

The current version of Ibotta’s app, which was introduced in 2012. (Thomas Gounley/BusinessDen)

Ibotta, a Denver-based firm that offers a modern-day version of couponing, has filed to go public and disclosed that it was profitable last year.

The company founded by CEO Bryan Leach in 2011 informed the U.S. Securities and Exchange Commission on Friday of its intent to go public, detailing its finances in the process.

Bryan Leach

The company, which did not disclose the size of the upcoming offering, said it had revenue of $320 million in 2023, up 52% from $210.7 million in 2022. Revenue tends to be highest toward the end of the year due to holiday shopping trends; the fourth quarter accounted for 31% of revenue both years.

The company said it made $38.1 million in profit in 2023, or 12 percent of revenue. That compares to a loss of $54.9 million in 2022. Since inception, the company has lost $209 million, per the SEC filing.

Ibotta released its mobile app in 2012. It allows users to get cash rebates when they show they’ve purchased specific products. Most of its offers are for categories considered “non-discretionary,” such as groceries.

The company said in its SEC filings that its app has 50 million registered users, but that customers can also redeem offers from retailers such as Walmart, Kroger and Shell without having an Ibotta account. Collectively, the company said it has given $1.8 billion in rebates.

Ibotta is paid by companies such as Coca-Cola and Nestle when customers take advantage of a rebate. For example, the company said in its SEC filing that for a product typically sold for $5.30, the company might invoice its client $2.10 for each redemption. Ibotta would then pass $1.30 of that on to the customer, keeping the remaining 80 cents.

Such “redemption revenue” accounted for 76% of the company’s total revenue in 2023, per the SEC filing. The remaining revenue came from selling advertising through its app as well as “monetizing aggregated data collected by our platform, and providing (consumer packaged goods) brands with marketing and consumer insights.”

The company said it works directly with 850 clients representing 2,400 different consumer packaged goods brands. It said it generates all its revenue from the U.S. and doesn’t have plans to expand internationally.

Walmart currently owns at least 5% of Ibotta, per the SEC filing, which doesn’t disclose the exact stake. Koch Industries led the company’s last disclosed financing round in 2019, which the company said valued it at $1 billion.

Ibotta is headquartered at 1801 California St. in downtown Denver and had 815 employees as of the end of last year, up from 530 at the end of 2012. The company was founded at Zing Enterprises before changing its name in 2012 to Ibotta, which plays off the phrase “I bought a.”

CEO Leach attended Harvard University and the University of Oxford before getting a degree from Yale Law School, per his LinkedIn profile. Prior to starting Ibotta, he was a partner at Bartlit Beck and served as a law clerk to former Supreme Court Justice David Souter, according to the company’s website.

Ibotta intends to list on the New York Stock Exchange under the ticker symbol IBTA.

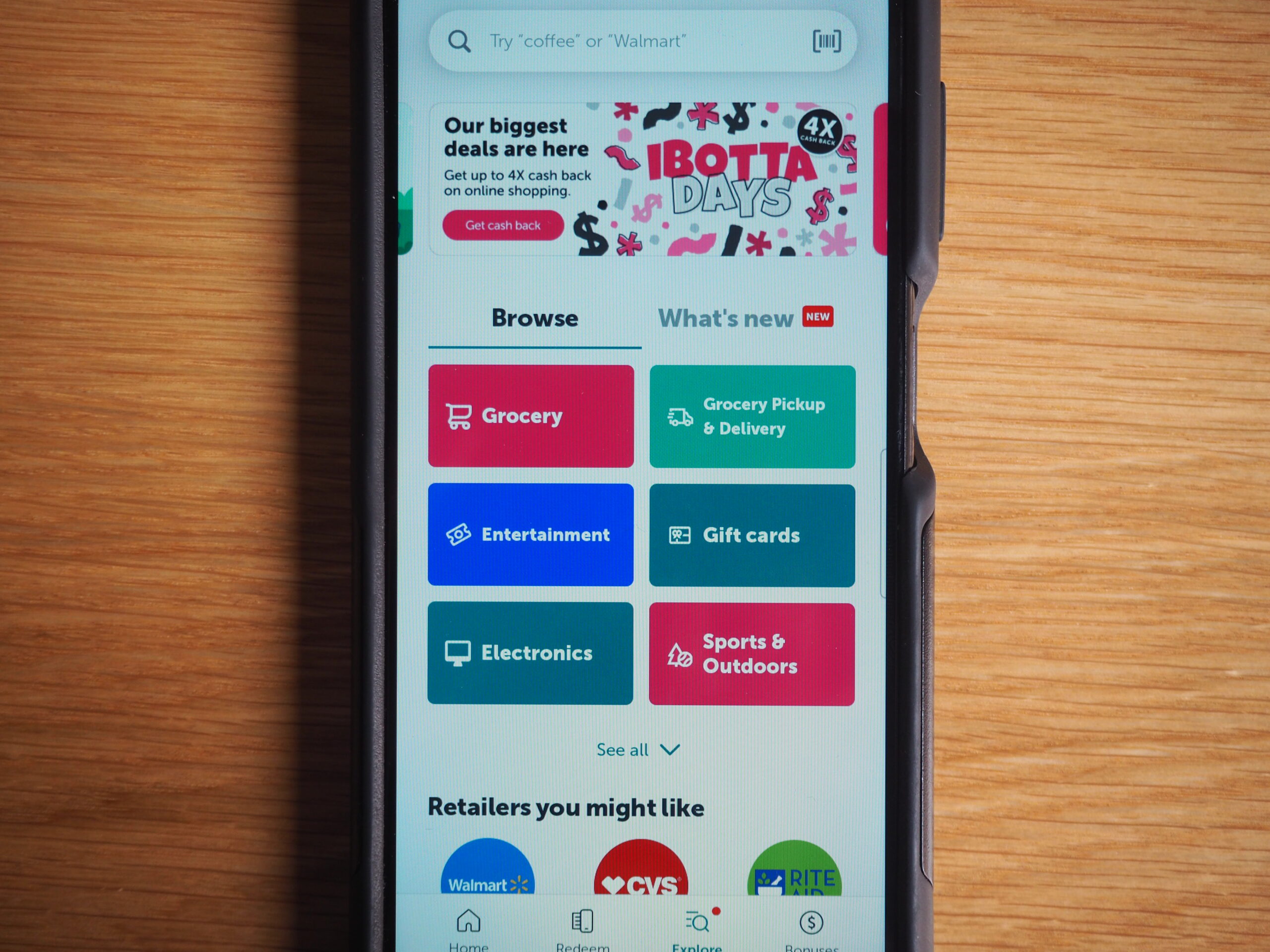

The current version of Ibotta’s app, which was introduced in 2012. (Thomas Gounley/BusinessDen)

Ibotta, a Denver-based firm that offers a modern-day version of couponing, has filed to go public and disclosed that it was profitable last year.

The company founded by CEO Bryan Leach in 2011 informed the U.S. Securities and Exchange Commission on Friday of its intent to go public, detailing its finances in the process.

Bryan Leach

The company, which did not disclose the size of the upcoming offering, said it had revenue of $320 million in 2023, up 52% from $210.7 million in 2022. Revenue tends to be highest toward the end of the year due to holiday shopping trends; the fourth quarter accounted for 31% of revenue both years.

The company said it made $38.1 million in profit in 2023, or 12 percent of revenue. That compares to a loss of $54.9 million in 2022. Since inception, the company has lost $209 million, per the SEC filing.

Ibotta released its mobile app in 2012. It allows users to get cash rebates when they show they’ve purchased specific products. Most of its offers are for categories considered “non-discretionary,” such as groceries.

The company said in its SEC filings that its app has 50 million registered users, but that customers can also redeem offers from retailers such as Walmart, Kroger and Shell without having an Ibotta account. Collectively, the company said it has given $1.8 billion in rebates.

Ibotta is paid by companies such as Coca-Cola and Nestle when customers take advantage of a rebate. For example, the company said in its SEC filing that for a product typically sold for $5.30, the company might invoice its client $2.10 for each redemption. Ibotta would then pass $1.30 of that on to the customer, keeping the remaining 80 cents.

Such “redemption revenue” accounted for 76% of the company’s total revenue in 2023, per the SEC filing. The remaining revenue came from selling advertising through its app as well as “monetizing aggregated data collected by our platform, and providing (consumer packaged goods) brands with marketing and consumer insights.”

The company said it works directly with 850 clients representing 2,400 different consumer packaged goods brands. It said it generates all its revenue from the U.S. and doesn’t have plans to expand internationally.

Walmart currently owns at least 5% of Ibotta, per the SEC filing, which doesn’t disclose the exact stake. Koch Industries led the company’s last disclosed financing round in 2019, which the company said valued it at $1 billion.

Ibotta is headquartered at 1801 California St. in downtown Denver and had 815 employees as of the end of last year, up from 530 at the end of 2012. The company was founded at Zing Enterprises before changing its name in 2012 to Ibotta, which plays off the phrase “I bought a.”

CEO Leach attended Harvard University and the University of Oxford before getting a degree from Yale Law School, per his LinkedIn profile. Prior to starting Ibotta, he was a partner at Bartlit Beck and served as a law clerk to former Supreme Court Justice David Souter, according to the company’s website.

Ibotta intends to list on the New York Stock Exchange under the ticker symbol IBTA.