Frank Azar, the personal injury attorney whose billboards dot Colorado’s highways and byways, has sued his former tax preparer for allegedly costing him a six-figure sum — again.

The lawsuit, filed Friday at a Centennial courthouse, reopens a years-old dispute between the high-profile lawyer and Timothy McKey, an accountant in Louisiana. It is one of several legal battles that the litigious Azar and his Aurora-based law firm are involved in.

In late 2017, Azar hired McKey and his companies in Baton Rouge to file Azar’s personal tax return and that of Azar & Associates. Two years later, the Internal Revenue Service accused Azar of underpaying federal taxes by $716,000. The case went to U.S. Tax Court.

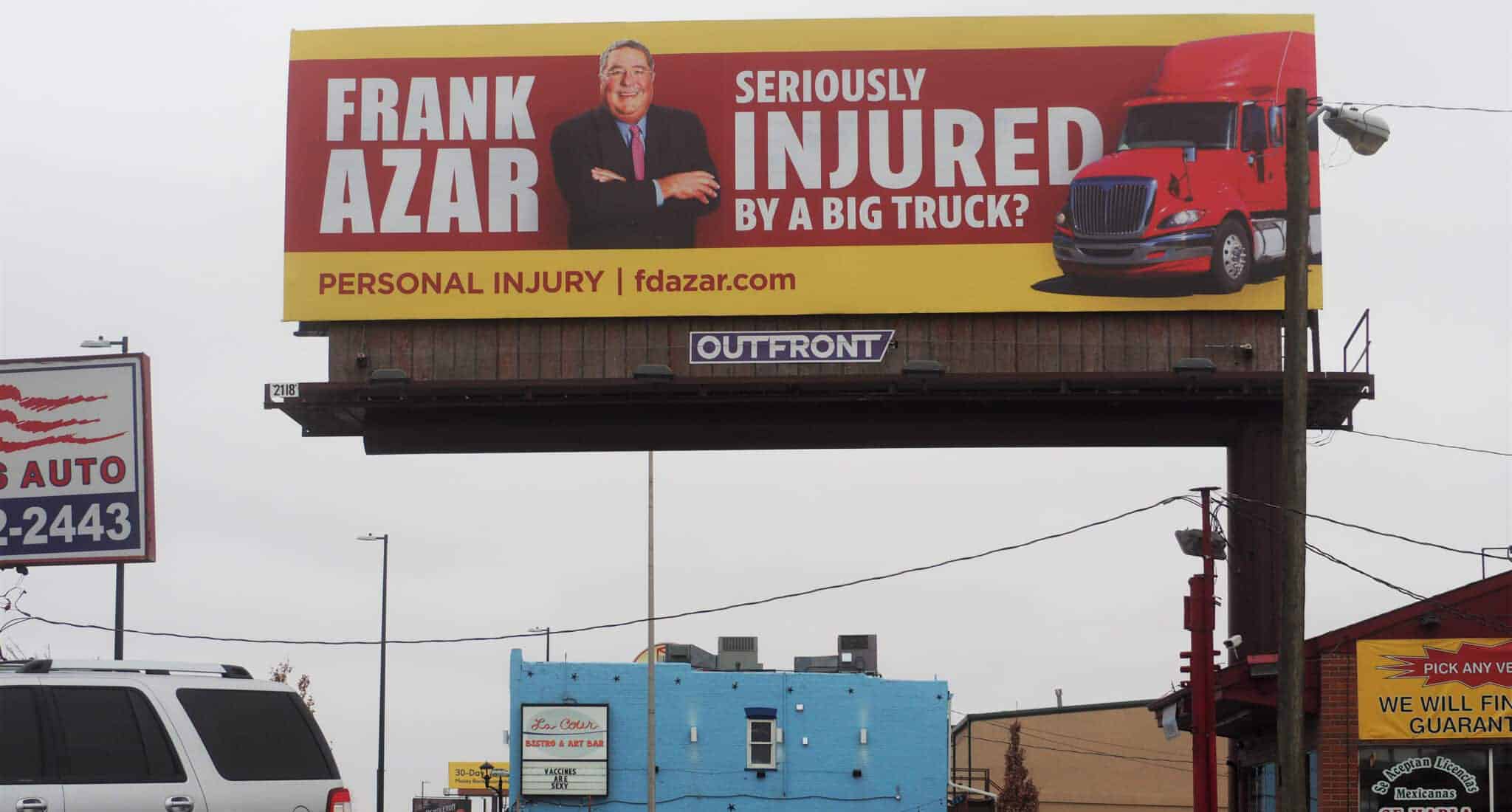

Frank Azar, a popular personal injury lawyer. (Photo courtesy of Franklin D. Azar & Associates)

Azar listed $3.9 million in taxable income for 2017. The IRS calculated the actual number to be $5.6 million, according to U.S. Tax Court records obtained by BusinessDen.

While litigating the Tax Court case, Azar sued McKey in 2021, accusing him of malpractice. The next year, he sued two Colorado accountants and accused them of botching his 2017 taxes after he fired McKey and hired them. That second case was settled in March.

Last May, Azar and McKey agreed to put their case on hold until Azar could determine how much money he owed the IRS in Tax Court and therefore how much money McKey’s alleged mistakes had cost him. In December 2022, Azar and the IRS reached a settlement in which he paid $769,270 to the government and the IRS, in turn, dropped a $143,000 fine.

With that matter settled, Azar is back to suing McKey for allegedly bungling his tax returns.

“Mr. Azar has incurred over $170,000 in legal accounting and tax preparation expenses, and accrued interest charges, related to correcting and resolving the problems created by the erroneous tax returns prepared and filed by Timothy McKey,” the lawsuit claims.

McKey and his attorneys did not respond to requests for comment. But in the 2021 case, McKey denied making any mistakes in the tax returns for Azar or Azar & Associates.

Unrelated to his scuffles with accountants, both Azar and his firm continue to litigate their case against Ivy Ngo, who ran the firm’s class-action division before she was fired in 2020.

Azar sued Ngo after her termination, accusing her of breaching employment and confidentiality contracts when she tried to recruit colleagues and clients away from Azar & Associates. Ngo countersued, accusing Azar of defaming her in front of clients and competitors.

In December, a Denver jury sided with Azar & Associates and ordered Ngo to pay it a nominal $4,000. District Court Judge David Goldberg then ordered Ngo to pay Azar’s attorney fees and court costs, which total about $1.2 million. Ngo is currently appealing both the jury’s decision and Goldberg’s order on fees and costs to the Colorado Court of Appeals.

Meanwhile, Azar & Associates is still suing its insurance company, Executive Risk Indemnity, in a Denver federal court for refusing to cover the costs it incurred in the Ngo litigation.

Frank Azar, the personal injury attorney whose billboards dot Colorado’s highways and byways, has sued his former tax preparer for allegedly costing him a six-figure sum — again.

The lawsuit, filed Friday at a Centennial courthouse, reopens a years-old dispute between the high-profile lawyer and Timothy McKey, an accountant in Louisiana. It is one of several legal battles that the litigious Azar and his Aurora-based law firm are involved in.

In late 2017, Azar hired McKey and his companies in Baton Rouge to file Azar’s personal tax return and that of Azar & Associates. Two years later, the Internal Revenue Service accused Azar of underpaying federal taxes by $716,000. The case went to U.S. Tax Court.

Frank Azar, a popular personal injury lawyer. (Photo courtesy of Franklin D. Azar & Associates)

Azar listed $3.9 million in taxable income for 2017. The IRS calculated the actual number to be $5.6 million, according to U.S. Tax Court records obtained by BusinessDen.

While litigating the Tax Court case, Azar sued McKey in 2021, accusing him of malpractice. The next year, he sued two Colorado accountants and accused them of botching his 2017 taxes after he fired McKey and hired them. That second case was settled in March.

Last May, Azar and McKey agreed to put their case on hold until Azar could determine how much money he owed the IRS in Tax Court and therefore how much money McKey’s alleged mistakes had cost him. In December 2022, Azar and the IRS reached a settlement in which he paid $769,270 to the government and the IRS, in turn, dropped a $143,000 fine.

With that matter settled, Azar is back to suing McKey for allegedly bungling his tax returns.

“Mr. Azar has incurred over $170,000 in legal accounting and tax preparation expenses, and accrued interest charges, related to correcting and resolving the problems created by the erroneous tax returns prepared and filed by Timothy McKey,” the lawsuit claims.

McKey and his attorneys did not respond to requests for comment. But in the 2021 case, McKey denied making any mistakes in the tax returns for Azar or Azar & Associates.

Unrelated to his scuffles with accountants, both Azar and his firm continue to litigate their case against Ivy Ngo, who ran the firm’s class-action division before she was fired in 2020.

Azar sued Ngo after her termination, accusing her of breaching employment and confidentiality contracts when she tried to recruit colleagues and clients away from Azar & Associates. Ngo countersued, accusing Azar of defaming her in front of clients and competitors.

In December, a Denver jury sided with Azar & Associates and ordered Ngo to pay it a nominal $4,000. District Court Judge David Goldberg then ordered Ngo to pay Azar’s attorney fees and court costs, which total about $1.2 million. Ngo is currently appealing both the jury’s decision and Goldberg’s order on fees and costs to the Colorado Court of Appeals.

Meanwhile, Azar & Associates is still suing its insurance company, Executive Risk Indemnity, in a Denver federal court for refusing to cover the costs it incurred in the Ngo litigation.