A local builder of luxury homes that has been sued several times for allegedly defrauding investors says it has fallen $1.6 million in debt and now needs to dissolve.

Denver-based RedCorp filed for Chapter 7 bankruptcy on Tuesday, Jan. 10. It reported only $42,250 in assets and has earned just $145,146 in revenue since the start of 2021.

Meanwhile, the company and its CEO, Larry Behrendt, face two ongoing lawsuits.

On the last day of 2021, RedCorp and Behrendt were sued by Diana Gonzalez, the mother of Behrendt’s former business partner, Apolo Sevilla. Gonzalez says she took out a $950,000 loan from FirstBank to help finance Behrendt and Sevilla’s real estate projects.

Instead of using the money to build, Behrendt moved $500,000 into a RedCorp bank account “to fund payroll, to build an addition to Behrendt’s personal residence and to otherwise fund Behrendt’s lifestyle,” according to Gonzalez’s lawsuit. She was forced to sell her house to repay FirstBank and was reimbursed only $130,000 by her son and Behrendt, she says.

RedCorp and Behrendt have denied the allegations. They sued Sevilla last August, blaming him for his mother’s financial losses. Sevilla then countersued RedCorp and Behrendt last week. A five-day jury trial is scheduled to begin June 5 in Denver District Court.

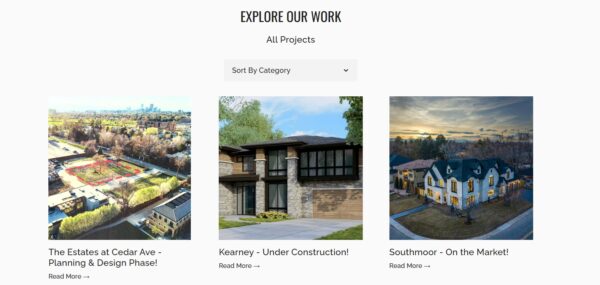

Many of RedCorp’s legal troubles involve a project that is still displayed prominently on its website: a six-bedroom, seven-bath, 8,500-square-foot house at 155 Southmoor Drive in the Hilltop neighborhood. It sold for $3.4 million in 2020 and $4.3 million in 2022.

The spec home was funded by investors who were supposed to receive a return on their investment after it was built and first sold in 2020. Lawsuits indicate they did not.

Christopher Parsons claimed in an October 2022 lawsuit that he invested $150,000 in the project in exchange for a 10.5-percent stake and an estimated profit of $439,000. But after the house was built, Behrendt told Parsons that the house had cost $4 million to build rather than the estimated $2.5 million, resulting in a $792,000 loss for investors.

Parsons believes the project actually turned a nearly $600,000 profit but the money was never sent to investors. Instead, he alleges, the profits went to RedCorp and Behrendt.

RedCorp and Behrendt have denied Parsons’ allegations and asked that the case be partially dismissed because Parsons “fails to plausibly allege his claims” of wrongdoing.

“As occasionally occurs, the project went over budget and did not produce the profits Mr. Parsons hoped to collect for his investment,” their motion to dismiss states.

Behrendt and RedCorp settled a similar lawsuit last summer by Gregory Delaney, a Denver man who invested $50,000 into 155 Southmoor Drive in exchange for a guaranteed 12-percent return, but allegedly received nothing after the property was built and sold in 2020.

“The numbers don’t make sense,” Sevilla told Delaney, according to the lawsuit. “Presumption is the money is gone. (Behrendt) needs to explain where the money has gone.”

Elsewhere in the Hilltop neighborhood, RedCorp built a seven-bedroom, eight-bathroom house that spans 7,200 square feet at 260 Kearney St. It sold for $2.5 million in 2020.

RedCorp and Behrendt did not respond to questions about the bankruptcy sent to them and their attorney, Aaron Conrardy of Wadsworth Garber Warner Conrardy in Littleton.

Conrardy is also representing Behrendt and his wife in their personal Chapter 7 bankruptcy case, which was filed the same day as RedCorp’s. The couple say they are $2.7 million in debt and have $1.3 million in assets, namely a mortgaged home in Denver.

A local builder of luxury homes that has been sued several times for allegedly defrauding investors says it has fallen $1.6 million in debt and now needs to dissolve.

Denver-based RedCorp filed for Chapter 7 bankruptcy on Tuesday, Jan. 10. It reported only $42,250 in assets and has earned just $145,146 in revenue since the start of 2021.

Meanwhile, the company and its CEO, Larry Behrendt, face two ongoing lawsuits.

On the last day of 2021, RedCorp and Behrendt were sued by Diana Gonzalez, the mother of Behrendt’s former business partner, Apolo Sevilla. Gonzalez says she took out a $950,000 loan from FirstBank to help finance Behrendt and Sevilla’s real estate projects.

Instead of using the money to build, Behrendt moved $500,000 into a RedCorp bank account “to fund payroll, to build an addition to Behrendt’s personal residence and to otherwise fund Behrendt’s lifestyle,” according to Gonzalez’s lawsuit. She was forced to sell her house to repay FirstBank and was reimbursed only $130,000 by her son and Behrendt, she says.

RedCorp and Behrendt have denied the allegations. They sued Sevilla last August, blaming him for his mother’s financial losses. Sevilla then countersued RedCorp and Behrendt last week. A five-day jury trial is scheduled to begin June 5 in Denver District Court.

Many of RedCorp’s legal troubles involve a project that is still displayed prominently on its website: a six-bedroom, seven-bath, 8,500-square-foot house at 155 Southmoor Drive in the Hilltop neighborhood. It sold for $3.4 million in 2020 and $4.3 million in 2022.

The spec home was funded by investors who were supposed to receive a return on their investment after it was built and first sold in 2020. Lawsuits indicate they did not.

Christopher Parsons claimed in an October 2022 lawsuit that he invested $150,000 in the project in exchange for a 10.5-percent stake and an estimated profit of $439,000. But after the house was built, Behrendt told Parsons that the house had cost $4 million to build rather than the estimated $2.5 million, resulting in a $792,000 loss for investors.

Parsons believes the project actually turned a nearly $600,000 profit but the money was never sent to investors. Instead, he alleges, the profits went to RedCorp and Behrendt.

RedCorp and Behrendt have denied Parsons’ allegations and asked that the case be partially dismissed because Parsons “fails to plausibly allege his claims” of wrongdoing.

“As occasionally occurs, the project went over budget and did not produce the profits Mr. Parsons hoped to collect for his investment,” their motion to dismiss states.

Behrendt and RedCorp settled a similar lawsuit last summer by Gregory Delaney, a Denver man who invested $50,000 into 155 Southmoor Drive in exchange for a guaranteed 12-percent return, but allegedly received nothing after the property was built and sold in 2020.

“The numbers don’t make sense,” Sevilla told Delaney, according to the lawsuit. “Presumption is the money is gone. (Behrendt) needs to explain where the money has gone.”

Elsewhere in the Hilltop neighborhood, RedCorp built a seven-bedroom, eight-bathroom house that spans 7,200 square feet at 260 Kearney St. It sold for $2.5 million in 2020.

RedCorp and Behrendt did not respond to questions about the bankruptcy sent to them and their attorney, Aaron Conrardy of Wadsworth Garber Warner Conrardy in Littleton.

Conrardy is also representing Behrendt and his wife in their personal Chapter 7 bankruptcy case, which was filed the same day as RedCorp’s. The couple say they are $2.7 million in debt and have $1.3 million in assets, namely a mortgaged home in Denver.