Home sale prices have increased sharply in the Denver area in recent months but homeowners will see a more tame increase when they receive their property valuation from the county in coming days.

Home sale prices have increased sharply in the Denver area in recent months but homeowners will see a more tame increase when they receive their property valuation from the county in coming days.

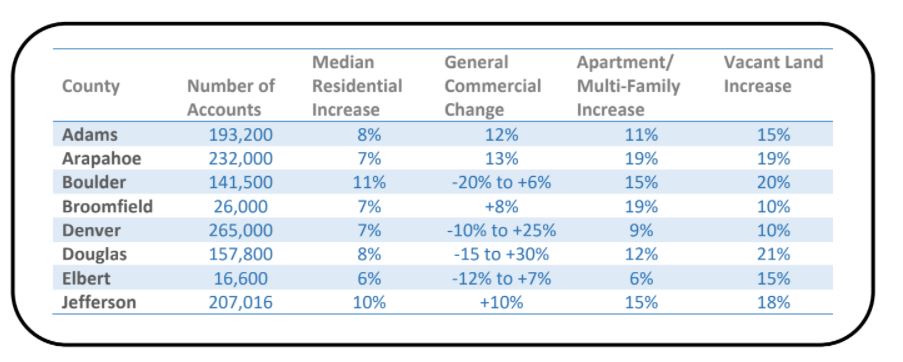

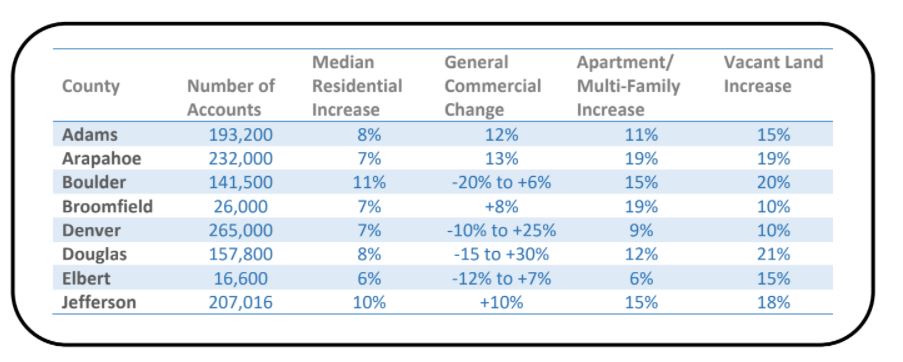

Among counties in the Denver area, Boulder County had the largest median valuation increase for residential properties, at 11 percent. Jefferson County was next at 10 percent, followed by Douglas and Adams counties at 8 percent.

Denver, Arapahoe and Broomfield counties had a median increase of 7 percent.

In Colorado, assessors value all properties in the state every two years, so the increases are based off the most recent valuations in 2019. The valuations then correspond to how much a property owner pays in taxes.

Local county assessors released the aggregate data on residential properties this week, along with median changes in various categories of commercial real estate. The offices are supposed to mail notices regarding individual property valuations by May 1.

Homes prices have been climbing in Denver and around the country thanks to low inventory and interest rates. The average sale price locally in March was up 15.3 percent year-over-year.

County valuations, however, didn’t increase sharply largely because the new numbers are based on an 18- or 24-month period ending June 30, 2020. That final date largely predates the pandemic housing boom.

The median valuation of apartment properties increased 7 percent in Denver, but 19 percent in Broomfield. Vacant land valuations increased between 10 and 21 percent locally, with Denver on the low end and Douglas County on the high end.

Valuation changes among other commercial real estate categories was more varied.

Denver Assessor Keith Erffmeyer spoke of the challenge of valuing properties during the pandemic in March, when he told BusinessDen that his office’s overall valuation of commercial property in Denver would decrease this cycle for the first time in a decade.

“Each property is different,” Erffmeyer said at the time. “Hotels will go down the most on a median standpoint, followed by retail, then offices. Not sure warehouses see decreases. Some might, but some might not.”

Home sale prices have increased sharply in the Denver area in recent months but homeowners will see a more tame increase when they receive their property valuation from the county in coming days.

Home sale prices have increased sharply in the Denver area in recent months but homeowners will see a more tame increase when they receive their property valuation from the county in coming days.

Among counties in the Denver area, Boulder County had the largest median valuation increase for residential properties, at 11 percent. Jefferson County was next at 10 percent, followed by Douglas and Adams counties at 8 percent.

Denver, Arapahoe and Broomfield counties had a median increase of 7 percent.

In Colorado, assessors value all properties in the state every two years, so the increases are based off the most recent valuations in 2019. The valuations then correspond to how much a property owner pays in taxes.

Local county assessors released the aggregate data on residential properties this week, along with median changes in various categories of commercial real estate. The offices are supposed to mail notices regarding individual property valuations by May 1.

Homes prices have been climbing in Denver and around the country thanks to low inventory and interest rates. The average sale price locally in March was up 15.3 percent year-over-year.

County valuations, however, didn’t increase sharply largely because the new numbers are based on an 18- or 24-month period ending June 30, 2020. That final date largely predates the pandemic housing boom.

The median valuation of apartment properties increased 7 percent in Denver, but 19 percent in Broomfield. Vacant land valuations increased between 10 and 21 percent locally, with Denver on the low end and Douglas County on the high end.

Valuation changes among other commercial real estate categories was more varied.

Denver Assessor Keith Erffmeyer spoke of the challenge of valuing properties during the pandemic in March, when he told BusinessDen that his office’s overall valuation of commercial property in Denver would decrease this cycle for the first time in a decade.

“Each property is different,” Erffmeyer said at the time. “Hotels will go down the most on a median standpoint, followed by retail, then offices. Not sure warehouses see decreases. Some might, but some might not.”

Leave a Reply