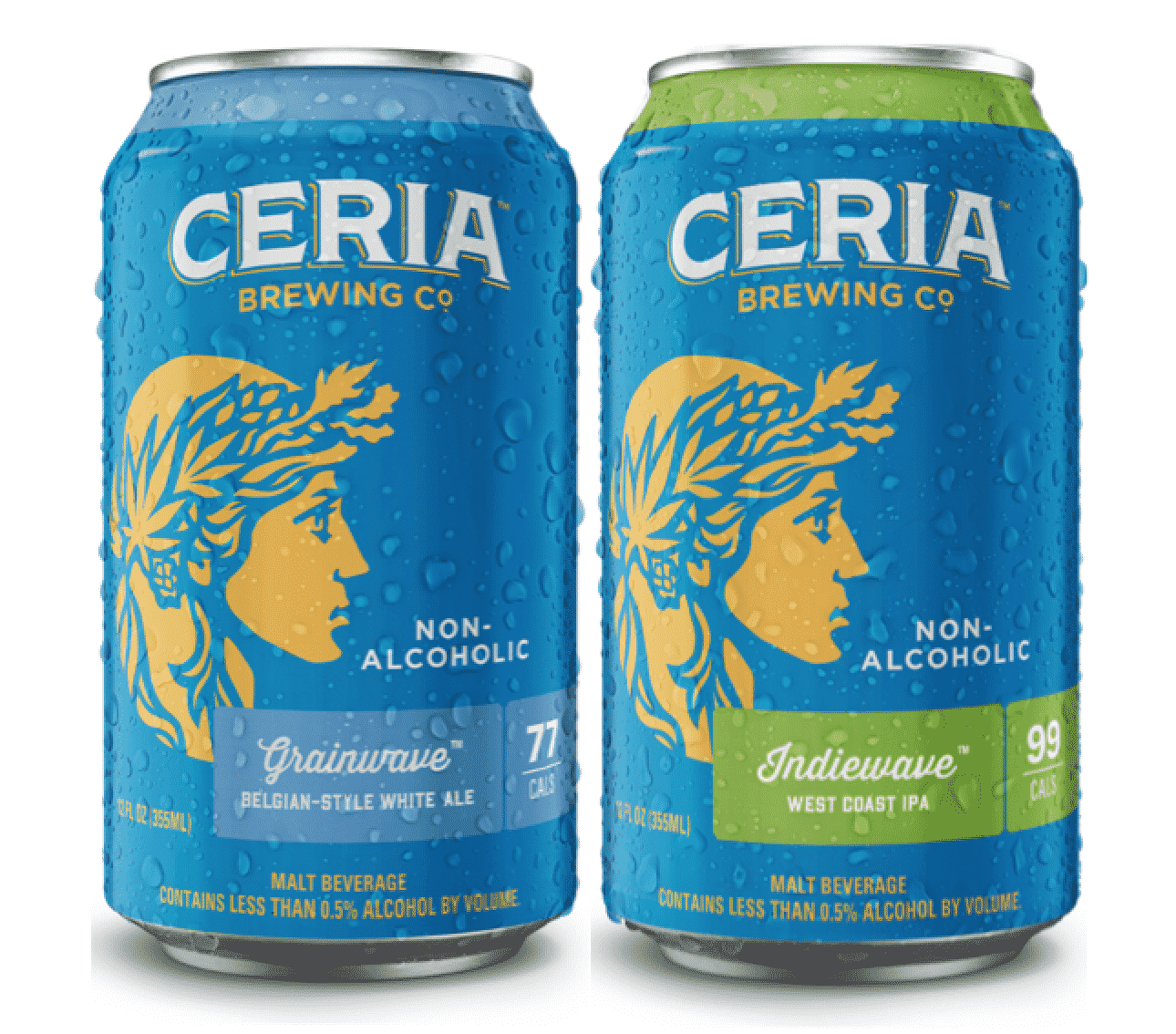

Blue Moon founder Keith Villa has created a nonalcoholic and THC-infused beer brand called Ceria. (Images courtesy of Ceria Brewing)

Keith Villa is feeling a sense of deja vu.

The brewmaster founded Blue Moon in 1995 during the rise of microbreweries in the U.S. Now, he’s focused on growing his new nonalcoholic and THC-infused beer brand, Ceria, in the midst of a “nonalcoholic beer movement,” he said.

“It’s almost like reliving the craft beer revolution all over again. Except, in this case, it’s comprised of NA beers and cannabis beverages, which are in their infancy right now,” Villa said. “One thing I pride myself on is looking at white space in the market — meaning trends brewers have not explored before. And here we are again 25 years later.”

Arvada-based Ceria Brewing, which Villa founded with his wife Jodi in 2018, closed on a $2.4 million funding round last month. Villa said he plans to use the funds to increase the brand’s marketing and sales efforts, as well as its production capabilities.

Villa would not disclose who participated in the round, but described the three investors as “high net worth individuals.”

Ceria has raised a total of $7.9 million, according to Villa. Prior to this round, the startup most recently raised $500,000 last March.

“We needed the round of investment because we have to get out there and spread the word about our brand,” Villa said. “We’re still very young, and because of that, not a lot of consumers have heard of us — and you need consumer pull to be successful. But what we found is once people taste it, then they love it, similar to Blue Moon.”

Still, he said, it took effort to get consumers to try Blue Moon.

“In those days, people were afraid of it because it was a crazy, new cloudy beer.”

Ceria has five employees based in its headquarters in Arvada. Villa said he will use some of the new funding to add to the sales team.

Villa worked at MillerCoors, which produces Blue Moon, for 32 years. He founded Ceria upon leaving the company, and began selling two types of nonalcoholic beer infused with THC and CBD. There’s Grainwave, a Belgian-style White Ale, and IPA Indiewave.

The infused version of the white ale has THC. The infused version of the IPA has THC and CBD. Ceria partners with Boulder-based Keef Brands and California-based GrowPacker for the infusions.

Both drinks are available for a range of $7 to $9 per 12 ounce can at various dispensaries in Denver, including The Green Solution, The Colfax Pot Shop and Cannabotica, and will soon be available in cannabis shops around California by the end of the year.

Villa, who has a doctorate in brewing science and fermentation biochemistry from a university in Belgium, said consumers began asking for beer without cannabis last year because they liked the taste but often couldn’t or didn’t want to consume the drink with cannabis.

Last year, Ceria began selling non-infused versions of its two beverages, which are sold for $30 per 12-pack on Amazon, in all Total Wine locations across the country and at Wegmans locations in the Northeast and Mid-Atlantic states.

“What most people don’t realize when entering the nonalcoholic beer industry is that you must pasteurize beverages without alcohol in order to protect the customers,” Villa said. “So, we also want to use some of the funds to help our brewing partners beef up their pasteurization capabilities.”

Nonalcoholic beer is expected to become a $29 billion industry by 2026, according to a recent report by Global Market Insights. The Great American Beer Festival, which is the world’s largest beer competition, added a nonalcoholic beer category in 2019 after it was previously removed in 2006 due to lack of interest and participation.

Although Ceria was the first Colorado brewery to introduce a THC-infused beer, it’s not the first to enter the nonalcoholic beer industry.

Ceria’s nonalcoholic beers are sold for $30 per 12-pack on Amazon and by retailers such as Total Wine and Wegmans.

Denver-based Gruvi claims that it introduced “Colorado’s first line of craft beers and wines without alcohol,” according to its website. And Longmont-based Bootstrap Brewing introduced a line of non-alcoholic IPA in November.

“A lot of the big brewers in the past made nonalcoholic beverages for a corporate responsibility strategy,” Villa said. “But now there’s a large segment of the population that’s into health and wellness. There are people who want to limit their alcohol intake, people who take medications you can’t drink on, or those with religious beliefs that prohibit them from drinking. And they are searching for flavorful beverages.”

Villa would not disclose revenue numbers but said Ceria’s overall sales tripled in 2020 compared to 2019. He added that Ceria is projecting to increase revenue this year by more than 50 percent and is looking to grow into more West Coast markets.

For now, the startup will focus on marketing its two flagship flavors.

“Blue Moon had five flavors when we first launched it, but by ’99 we had canceled all of them except for the Belgian White, which was our lead seller,” Villa said. “We realized that focusing on one flavor helped build the brand’s recognition.”

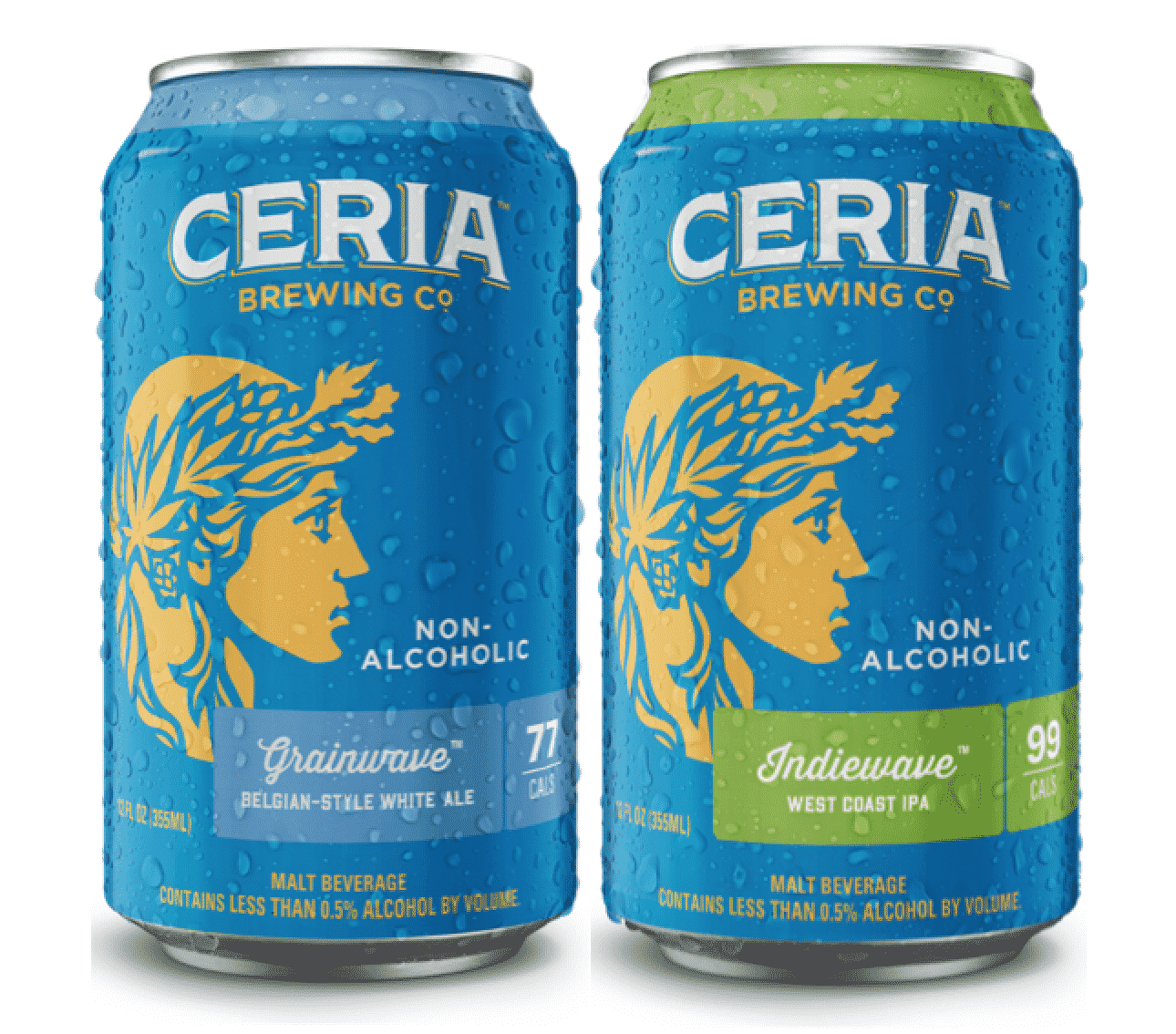

Blue Moon founder Keith Villa has created a nonalcoholic and THC-infused beer brand called Ceria. (Images courtesy of Ceria Brewing)

Keith Villa is feeling a sense of deja vu.

The brewmaster founded Blue Moon in 1995 during the rise of microbreweries in the U.S. Now, he’s focused on growing his new nonalcoholic and THC-infused beer brand, Ceria, in the midst of a “nonalcoholic beer movement,” he said.

“It’s almost like reliving the craft beer revolution all over again. Except, in this case, it’s comprised of NA beers and cannabis beverages, which are in their infancy right now,” Villa said. “One thing I pride myself on is looking at white space in the market — meaning trends brewers have not explored before. And here we are again 25 years later.”

Arvada-based Ceria Brewing, which Villa founded with his wife Jodi in 2018, closed on a $2.4 million funding round last month. Villa said he plans to use the funds to increase the brand’s marketing and sales efforts, as well as its production capabilities.

Villa would not disclose who participated in the round, but described the three investors as “high net worth individuals.”

Ceria has raised a total of $7.9 million, according to Villa. Prior to this round, the startup most recently raised $500,000 last March.

“We needed the round of investment because we have to get out there and spread the word about our brand,” Villa said. “We’re still very young, and because of that, not a lot of consumers have heard of us — and you need consumer pull to be successful. But what we found is once people taste it, then they love it, similar to Blue Moon.”

Still, he said, it took effort to get consumers to try Blue Moon.

“In those days, people were afraid of it because it was a crazy, new cloudy beer.”

Ceria has five employees based in its headquarters in Arvada. Villa said he will use some of the new funding to add to the sales team.

Villa worked at MillerCoors, which produces Blue Moon, for 32 years. He founded Ceria upon leaving the company, and began selling two types of nonalcoholic beer infused with THC and CBD. There’s Grainwave, a Belgian-style White Ale, and IPA Indiewave.

The infused version of the white ale has THC. The infused version of the IPA has THC and CBD. Ceria partners with Boulder-based Keef Brands and California-based GrowPacker for the infusions.

Both drinks are available for a range of $7 to $9 per 12 ounce can at various dispensaries in Denver, including The Green Solution, The Colfax Pot Shop and Cannabotica, and will soon be available in cannabis shops around California by the end of the year.

Villa, who has a doctorate in brewing science and fermentation biochemistry from a university in Belgium, said consumers began asking for beer without cannabis last year because they liked the taste but often couldn’t or didn’t want to consume the drink with cannabis.

Last year, Ceria began selling non-infused versions of its two beverages, which are sold for $30 per 12-pack on Amazon, in all Total Wine locations across the country and at Wegmans locations in the Northeast and Mid-Atlantic states.

“What most people don’t realize when entering the nonalcoholic beer industry is that you must pasteurize beverages without alcohol in order to protect the customers,” Villa said. “So, we also want to use some of the funds to help our brewing partners beef up their pasteurization capabilities.”

Nonalcoholic beer is expected to become a $29 billion industry by 2026, according to a recent report by Global Market Insights. The Great American Beer Festival, which is the world’s largest beer competition, added a nonalcoholic beer category in 2019 after it was previously removed in 2006 due to lack of interest and participation.

Although Ceria was the first Colorado brewery to introduce a THC-infused beer, it’s not the first to enter the nonalcoholic beer industry.

Ceria’s nonalcoholic beers are sold for $30 per 12-pack on Amazon and by retailers such as Total Wine and Wegmans.

Denver-based Gruvi claims that it introduced “Colorado’s first line of craft beers and wines without alcohol,” according to its website. And Longmont-based Bootstrap Brewing introduced a line of non-alcoholic IPA in November.

“A lot of the big brewers in the past made nonalcoholic beverages for a corporate responsibility strategy,” Villa said. “But now there’s a large segment of the population that’s into health and wellness. There are people who want to limit their alcohol intake, people who take medications you can’t drink on, or those with religious beliefs that prohibit them from drinking. And they are searching for flavorful beverages.”

Villa would not disclose revenue numbers but said Ceria’s overall sales tripled in 2020 compared to 2019. He added that Ceria is projecting to increase revenue this year by more than 50 percent and is looking to grow into more West Coast markets.

For now, the startup will focus on marketing its two flagship flavors.

“Blue Moon had five flavors when we first launched it, but by ’99 we had canceled all of them except for the Belgian White, which was our lead seller,” Villa said. “We realized that focusing on one flavor helped build the brand’s recognition.”

Leave a Reply