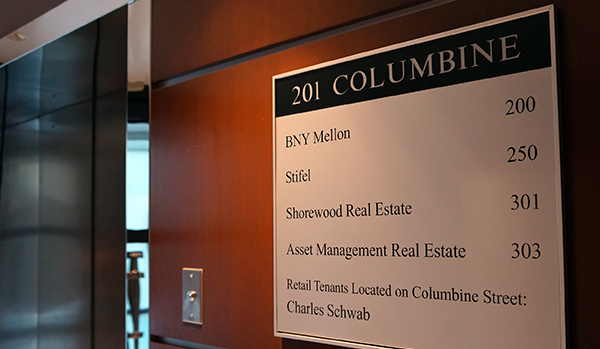

LBH Corp. controls residential real estate brokerages under the brand Shorewood. <em>Photo by Amy DiPierro.</em>

New bankruptcy filings show that Shorewood Real Estate, a residential brokerage owned by a company based in Cherry Creek, is facing nearly $6 million in debt and three pending lawsuits.

LBH Corp., which owns California residential real estate brokerages under the brand name Shorewood, reported $5.8 million in debts against $450,000 in assets according to a recent filing in U.S. Bankruptcy Court.

LBH has offices at Second Avenue and Columbine Street in Cherry Creek. The company filed for bankruptcy last month, though a spokesperson said the move would not affect brokerage operations in Colorado.

Documents filed last week also show revenue at LBH rose from $34.8 million in 2014 to $38.1 million in 2015. The company made $13.8 million from January until its June filing date. At the same time, the company reported debts of $5.8 million on $450,000 in assets.

LBH Corp. is led by Roger Herman, a Colorado real estate entrepreneur who founded the Herman Group more than 10 years ago. Herman bought the Shorewood, a residential real estate brokerage that was then based in Los Angeles County, in 2014. He then took down The Herman Group signs at his Colorado office to start operating under the Shorewood brand earlier this year.

In an interview last week with southern California newspaper Easy Reader News, Herman said LBH filed for bankruptcy to stay a lawsuit from its former franchisor, ERA Franchise Systems.

“It was a strategic move; most of our agents understand,” Herman told Easy Reader. “Some are concerned, some customers are concerned, but there is no effect on our customers or clients in any way, shape or form.”

ERA Franchise System sued LBH in February, saying LBH defaulted on a franchise agreement and a convertible debt note, and that LBH owes ERA more than $6 million.

ERA has since objected to LBH’s bankruptcy filings, arguing that it should be first in line for payment. LBH claimed in bankruptcy filings last week that it only owes ERA $1.5 million.

Shorewood founder Arnold D. Goldstein is among the company’s unsecured creditors, according to court documents. A pair of trusts associated with Goldstein and Shorewood co-founder Larry Wolf have a $3.75 million claim, making the trusts LBH’s single largest unsecured creditor.

Shorewood general counsel David Donnelly told BusinessDen last month that Shorewood’s Colorado offices will not be affected by the bankruptcy filing.

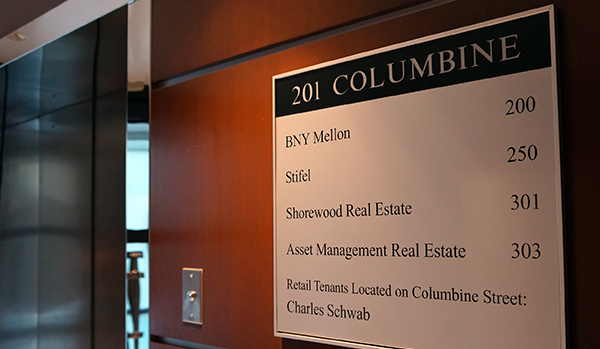

LBH Corp. controls residential real estate brokerages under the brand Shorewood. <em>Photo by Amy DiPierro.</em>

New bankruptcy filings show that Shorewood Real Estate, a residential brokerage owned by a company based in Cherry Creek, is facing nearly $6 million in debt and three pending lawsuits.

LBH Corp., which owns California residential real estate brokerages under the brand name Shorewood, reported $5.8 million in debts against $450,000 in assets according to a recent filing in U.S. Bankruptcy Court.

LBH has offices at Second Avenue and Columbine Street in Cherry Creek. The company filed for bankruptcy last month, though a spokesperson said the move would not affect brokerage operations in Colorado.

Documents filed last week also show revenue at LBH rose from $34.8 million in 2014 to $38.1 million in 2015. The company made $13.8 million from January until its June filing date. At the same time, the company reported debts of $5.8 million on $450,000 in assets.

LBH Corp. is led by Roger Herman, a Colorado real estate entrepreneur who founded the Herman Group more than 10 years ago. Herman bought the Shorewood, a residential real estate brokerage that was then based in Los Angeles County, in 2014. He then took down The Herman Group signs at his Colorado office to start operating under the Shorewood brand earlier this year.

In an interview last week with southern California newspaper Easy Reader News, Herman said LBH filed for bankruptcy to stay a lawsuit from its former franchisor, ERA Franchise Systems.

“It was a strategic move; most of our agents understand,” Herman told Easy Reader. “Some are concerned, some customers are concerned, but there is no effect on our customers or clients in any way, shape or form.”

ERA Franchise System sued LBH in February, saying LBH defaulted on a franchise agreement and a convertible debt note, and that LBH owes ERA more than $6 million.

ERA has since objected to LBH’s bankruptcy filings, arguing that it should be first in line for payment. LBH claimed in bankruptcy filings last week that it only owes ERA $1.5 million.

Shorewood founder Arnold D. Goldstein is among the company’s unsecured creditors, according to court documents. A pair of trusts associated with Goldstein and Shorewood co-founder Larry Wolf have a $3.75 million claim, making the trusts LBH’s single largest unsecured creditor.

Shorewood general counsel David Donnelly told BusinessDen last month that Shorewood’s Colorado offices will not be affected by the bankruptcy filing.

Leave a Reply